Energy demand in India is far outstripping the supply. Solar power offers a huge opportunity to bridge this widening gap between demand and supply. However, there are concerns over the solar industry’s readiness against the backdrop of a sleuth of changes in the business environment like continuous tariff falls, the slow pace of new tender announcements and the introduction of GST. Let’s delve deeper to get the complete picture.

India grabs the power baton

A survey by Wood Mackenzie on the global energy markets, which focuses on the upcoming market shifts, concludes that global energy demand will keep rising through 2035.

However, the nature of the energy mix, demand centres and key players will change significantly. The report also predicts that energy demand in India will grow the fastest, at an average rate of 3 per cent annually from now to 2035, by which time the country’s population will outgrow even China’s. Renewable energy sources will surge from 22 per cent to 54 per cent of the total installed capacity, while oil consumption will rise by 80 per cent. According to an Indian Brand Equity Foundation (IBEF) report, India ranks third among 40 countries in Ernst and Young’s Renewable Energy Country Attractiveness Index.

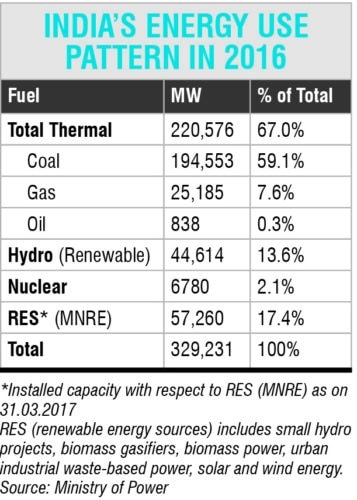

With a production of 1,400,800GWh in 2016, India is the third largest producer as well as the third largest consumer of electricity in the world. Although power generation has grown manifold since Independence, demand has been even higher due to accelerating economic activity. India has a diversified power sector with energy sources ranging from the conventional coal, natural gas, oil, hydro and nuclear power to renewable sources such as wind, solar and biological waste. According to data available from the Ministry of Power (Table), renewable energy sources accounted for around 17.4 per cent of India’s total installed power capacity in March 2017.

Solar rising faster

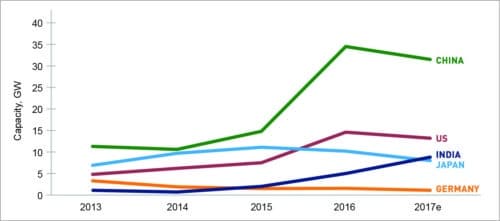

Solar power has quickly become a sizeable part of India’s energy mix. According to GTM Research and a Bridge To India (BTI) report, the total solar PV capacity installed globally had surpassed 300GW by the end of 2016. Of this, 77GW was added in 2016—a year-on-year growth rate of 34 per cent. China led with 34.5GW, followed by the USA (14.5GW) and Japan (10.2GW), with India (5GW) in fourth place.

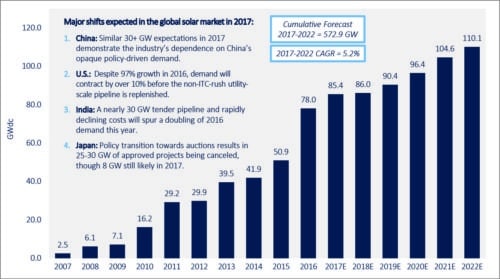

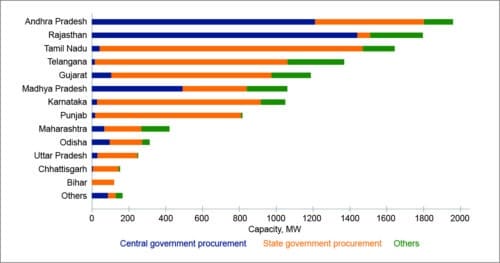

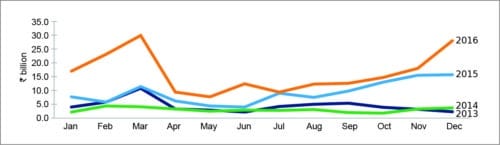

In 2017, India is expected to continue its rapid growth in solar power. With 8.8GW of projected capacity addition (a growth of 76 per cent over 2016), the country is set to become the third largest PV market in 2017, overtaking Japan (Figs 1 and 2). The GTM report also mentioned that, as of March 31, 2017, India had installed 12.2GW of utility-scale solar PV capacity. Till date, the southern states of Tamil Nadu, Andhra Pradesh and Telangana have taken the lead in solar installation projects (Fig. 3). This year, approximately 60 per cent of new solar capacity addition is expected to come from Telangana, Andhra Pradesh and Karnataka.

Tariff at stake

The wide-scale adoption of solar energy, coupled with the sharp decline in solar module prices in the global market by almost 30 per cent (a trend that is likely to continue next year also) due to a supply glut, has resulted in an abrupt fall of solar power tariff in India. In the last one year, the Indian solar sector experienced almost 50 per cent tariff reduction, with 25 per cent drop happening in just the last three months.

Fig. 1: Solar capacity addition in the leading countries (Source: BTI, GTM Research)

In May this year, India’s solar power tariffs fell to a new all-time low of 3.8 US cents (approx.₹ 2.40) per unit during the 250MW capacity auction at Bhadla in Rajasthan. South Africa’s Phelan Energy Group and Avaada Power won contracts to build capacities of 50MW and 100MW, respectively, at the Adani Renewable Energy Park Rajasthan.

Fig. 2: Global PV demand 2007-22 (Source: GTM Research)

Solar power prices have been falling

Falling solar power prices have prompted the Indian government to focus on renewable energy resources. However, new tender announcements from the government have slowed down, as it is encouraging greater private-sector participation. This has intensified the competition amongst developers. Interestingly, only a few new tenders are slated for the next year, and there is a complete lack of pipeline visibility over that period. Therefore it seems that the current tariff rates are hardly sustainable.

Falling tariffs are a double-edged sword for the solar sector. While these make solar power more attractive for consumers, investors and lenders get jittery. These tariffs are also creating uncertainty amongst policymakers, while causing new risks for older projects auctioned at tariffs that are two to three times higher.

The sharp reduction of tariffs may commoditise the Indian solar market rapidly and profit margins are bound to squeeze across the value chain. Therefore solar players need to innovate new technologies and business strategies to survive in this ultra-low-tariff scenario.

Fig. 3: State-wise commissioned solar capacity as of March 31, 2017 (Source: BTI)

Is domestic solar equipment manufacturing a distant dream?

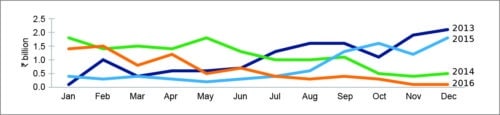

Being a lucrative solar power market, India attracts both global and local investors. However, the country is far from attaining self-reliance in solar module manufacturing. According to Ministry of Commerce data, India imported 5.7GW or about 89 per cent (84 per cent from China alone) of its total solar module requirements in FY 2016-17 (Fig. 4). The total value of these imports is estimated at US$3 billion, equivalent to 2.8 per cent of the country’s total merchandise trade deficit.

Fig. 4: Solar module imports by India (Source: Ministry of Commerce, GoI)

According to a BTI estimate, India’s total module manufacturing capacity is 5.286GW. However, most of this capacity is obsolete, sub-scale and uncompetitive. Total domestic production in 2016 was about 1.33GW. Adani is the biggest module manufacturer with 1.2GW capacity, followed by Waaree, Vikram and Emmvee with capacities of 500MW each.

Though solar module imports have increased significantly in the last four years in line with growth in capacity addition, exports have dropped notably (Fig. 5).

Fig. 5: Solar module exports from India (Source: Ministry of Commerce, GoI)

This increasing dependence on imports in a growing and strategically important solar sector has created various stress points in the Indian economy, which may lead to an abrupt policy reaction by the government. However, the Indian government needs to consider long-term implications for the sector and chalk out a well thought-out plan for domestic manufacturing instead of introducing short-term support measures to counter China’s monopoly in this sector.

Advances in the chinese market

China has announced huge subsidies and other support measures to scale up its solar PV manufacturing and dominate the global market. This has resulted in a massive increase in the Chinese manufacturing capacity from 23GW in 2013 to over 70GW today, despite the steep fall in prices. China also provides support for new technologies through its ‘Top Runner’ programme, which encourages the industry to migrate to higher-efficiency PV products.

So far, the Indian government’s priority has been to increase generation capacity and lower tariffs. But in the absence of a proper domestic manufacturing ecosystem, such measures are not enough to enable Indian manufacturers to compete with Chinese imports.

Is GST ‘good and simple’ enough?

In accordance with the ‘one nation one tax’ policy, solar panels and solar PV cells now attract a concessional GST rate of 5 per cent. This GST rate as against the effective 0 per cent rate of taxation will increase the total project costs.

However, the increase in project costs may be offset by the following factors:

1. Removal of the cascading effect of taxes

2. Availability of input credit resulting in improved cash flows and EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortisation)

3. Reduction in administrative and warehouse costs due to the abolition of multiple tax compliance requirements

4. Reduction of tariff-related trade barriers across the country enabling the growth of a common market

Taxation on solar products

The same GST rate of 5 per cent has been extended to all equipment for solar power generating plants or other capital goods used in solar projects. However, there is still a lack of clarity on ‘other’ capital goods used in solar projects. There is confusion in the market on how to avail the concessional 5 per cent GST rate when many of the same components are taxed at higher rates for use in other industries. For example, transformers are taxed at 5 per cent for solar projects as against 18 per cent for other applications. In the absence of any specific notification for solar projects, the GST rates vary from 18 per cent for capital goods, such as inverters and module mounting structures, to 28 per cent for cables and batteries.

According to BTI estimates, if all capital goods for solar projects are taxed at 5 per cent rate, the overall increase in EPC costs will be around 3 per cent. However, if only modules are taxed at 5 per cent and other capital goods are taxed at 18-28 per cent rates, the net increase in EPC costs is expected to be around 6 per cent.

With global solar module prices firming up due to extension of the solar Feed-in Tariff deadline in China, GST has come at an unfavourable time for the solar sector in India. Project delays can be expected and one cannot rule out the risk of litigation between project developers and discoms over the sharing of additional costs. The adverse impact will also be felt in the rooftop solar market, where market activity is expected to slow down in the near future.

Moving forward

Solar power as a clean energy technology option has already surpassed expectations, and this trend could continue. However, availability of grid-scale energy storage is critical to ensure sustainable growth of the solar sector. Therefore the onus lies with the energy storage industry to deliver low-cost yet reliable storage solutions.