Can India break free from its reliance on imported electronics and emerge as the next global manufacturing giant? The electronics component manufacturing scheme (ECMS) aims to make that leap possible, backed by billions in incentives, ambitious targets, and a tight timeline. But the real question remains: Can India overcome entrenched challenges and reshape its electronics future?

Table of Contents

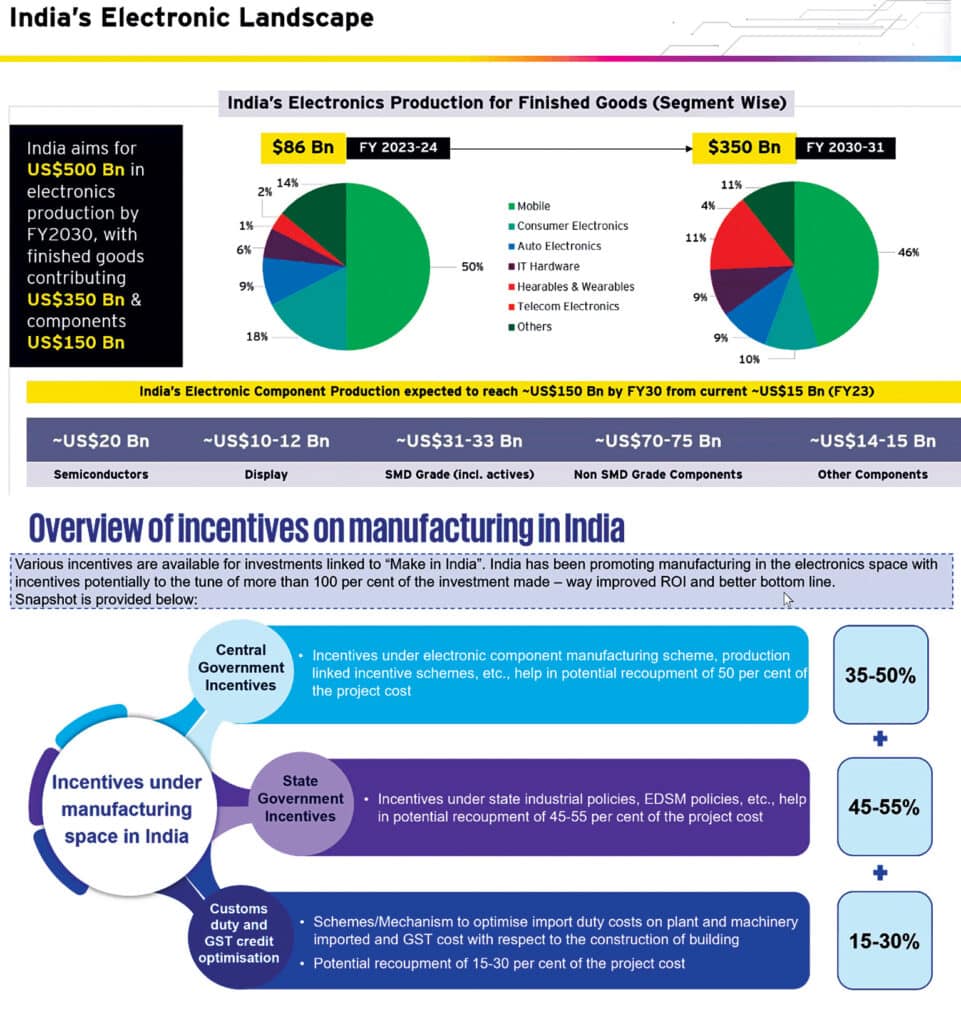

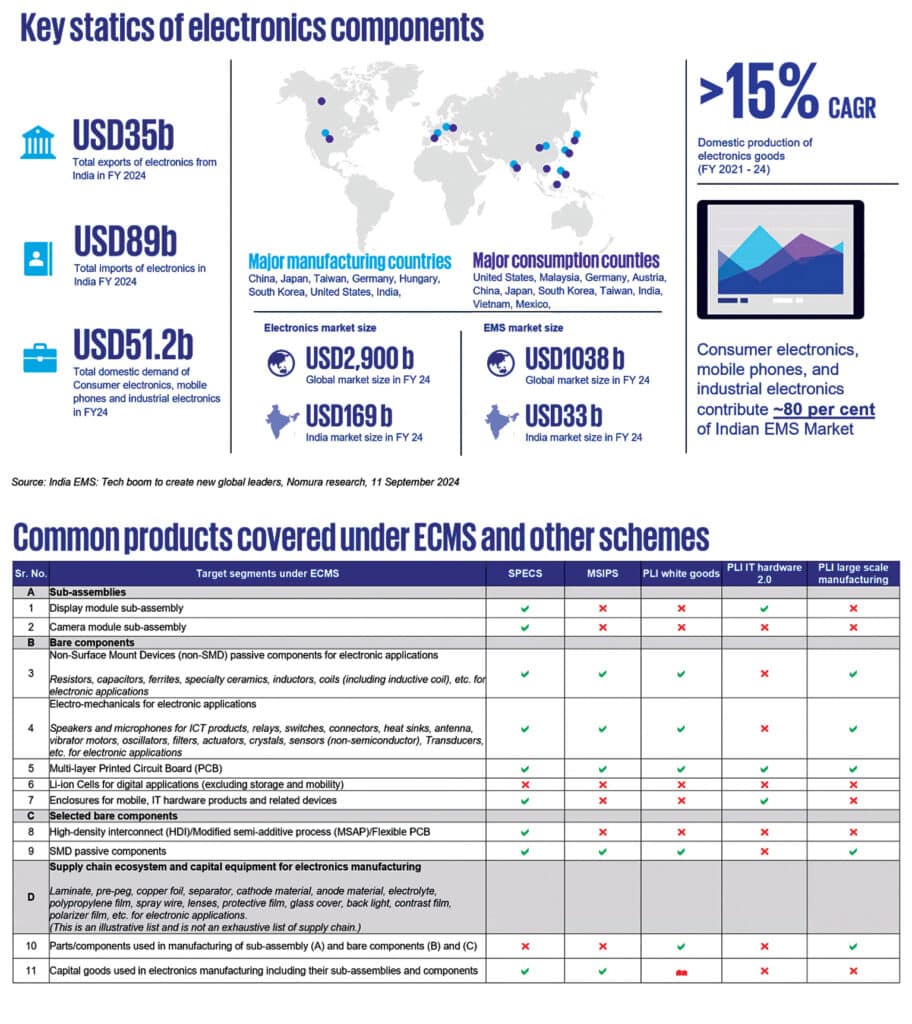

India’s electronics sector is undergoing a structural shift, from assembling finished products to building a self-reliant, globally competitive manufacturing base. Domestic production has grown at over 15% CAGR (FY21-FY24), with exports touching US$35 billion in FY24. The government now targets US$500 billion in total production by FY2030, including US$150 billion in components.

However, the sector remains heavily import-dependent, sourcing 80-85% of its components—including semiconductors and printed circuit boards (PCBs)—from Asia due to limited local design and manufacturing capabilities.

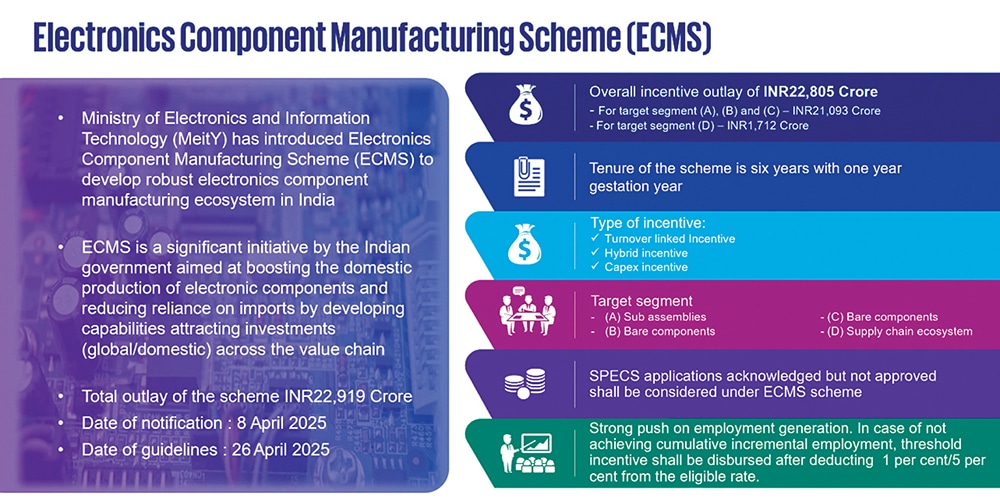

To address this, India launched the Electronics Component Manufacturing Scheme (ECMS) in April 2025, its most ambitious initiative yet, alongside other programmes like PLI, SPECS, and MSIPS. These schemes offer combined central and state incentives exceeding 100% of the investment, through a mix of subsidies and tax credits.

The incentives, tailored to component categories and production models, aim to reduce import reliance, attract investment, enhance value addition (currently just 15-18%), and integrate Indian firms into global value chains.

Driven by ‘Make in India’ and supported by a robust policy framework, India is positioning itself as a key player in the $2900 billion global electronics market.

Why ECMS? The strategic need

Despite India’s emergence as a major hub for electronics assembly, a staggering 70-80% of components, resistors, capacitors, connectors, and more, are still imported, mostly duty-free under ITA-11. This heavy reliance inflates the import bill, limits domestic value addition, and exposes India to global supply chain shocks. The Covid-19 pandemic highlighted these vulnerabilities, as supply disruptions threatened the entire industry. The ECMS seeks to change this dynamic by enabling India to transition from an assembler to a true manufacturing leader.

Scheme scale, scope, and ambition

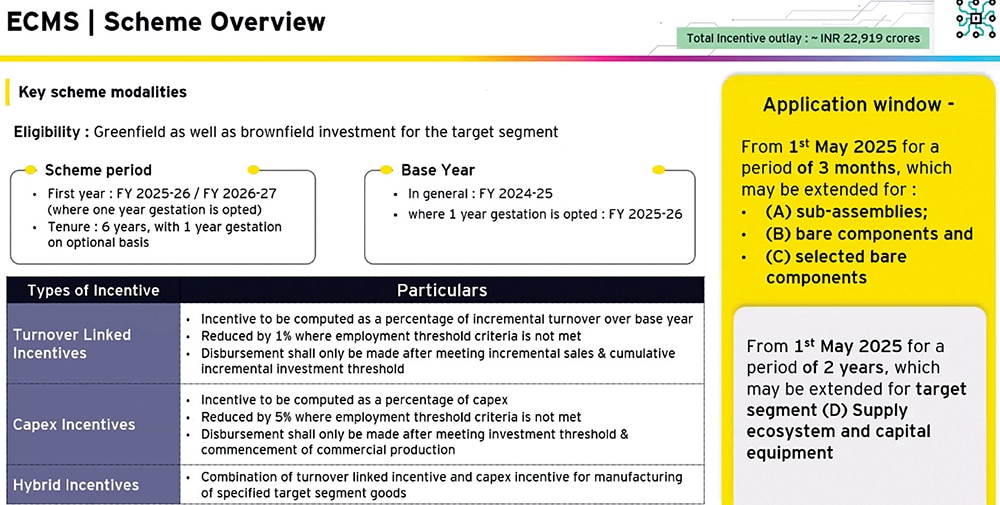

The ECMS is designed to catalyse India’s electronics sector by attracting investments of ₹593.5 billion, achieving a targeted production output of ₹4565 billion, and generating 91,600 direct jobs, with many more expected indirectly. The scheme is open to both greenfield (new) and brownfield (existing) investments, covering a broad range of segments, including sub-assemblies, bare components, selected bare components, the supply ecosystem, and capital equipment.

ECMS offers three types of incentives to participating companies. The turnover-linked incentive is calculated as a percentage of incremental turnover over a base year and is reduced by 1% if employment thresholds are not met. This incentive is disbursed upon achieving specific sales or investment targets.

The details are shown in Fig. 6.

The capex incentive is a percentage of capital expenditure, reduced by 5% if employment criteria are unmet, and is disbursed after investment and the commencement of commercial production. A hybrid incentive combines both turnover-linked and capital expenditure (Capex) incentives for specified goods, providing flexibility based on the nature of the investment and product segment.

Strategically, the scheme aims to reduce India’s import dependence, particularly on China, by strengthening domestic value addition and integrating Indian firms into global value chains. The allocation of incentives operates on a first-come, first-served basis, encouraging early participation.

There is a strong emphasis on quality and innovation, with requirements for design teams and adherence to Six Sigma quality standards; failure to comply may result in exclusion from the scheme. The impact of ECMS extends beyond electronics, supporting the industrial, power, and automotive sectors. State governments also play a supportive role, with some, like Tamil Nadu, offering matching grants to amplify the central scheme’s impact.

This collaborative approach between central and state governments, coupled with international partnerships, is expected to further expand the electronics manufacturing ecosystem in India.

| Table 1: Key facts of ECMS | |

| Feature | Details |

| Budget | ₹22,919 crore (US$2.7 billion) |

| Duration | 6 years (FY 2025-26 to 2031-32) with an optional one-year gestation period |

| Investment Target | ₹593.50 billion |

| Output Target | ₹4565 billion |

| Direct Jobs Target | 916 billion |

| Application Start | • For sub-assemblies, bare components, and selected bare components: Opens 1st May 2025, for three months (possible extension) • For supply ecosystem and capital equipment: Two years from 1st May 2025 (possible extension) |

| Incentive Types | Turnover-linked, Capex, Hybrid |

| Base Year | FY 2024-25 (or FY 2025-26 with gestation) |

| Sectors Covered | Electronics, Industrial, Power, Auto |

What Does ECMS Cover?