India must concentrate on electronics products and semiconductor components, as progress in one area reinforces the other. The country can unlock immense economic opportunities and enhance its global standing by aiming to capture a significant market share in these areas.

A country’s identity is determined by the products that the country creates, and technical progress is intrinsically linked to the innovative products that the country brings to the market. When we think of such a country, one name that often comes to mind is Japan. Products like Sony, Toyota, and Toshiba are synonymous with Japan’s identity. The types of products a country creates fundamentally define the destiny of a country and its place on the world map.

In the modern era, electronics and semiconductors have emerged as the lifeline for everyone. We use hundreds of semiconductor chips daily, driving almost every electronics product. From the moment we wake up to the car we drive, the computer we use, the mobile devices that keep us connected, movies and music we hear, electronics and semiconductor devices that drive them play an omnipresent role. These technologies are not limited to personal use – they permeate every sector, including education, mobility, healthcare, infrastructure, defence, space, etc. Electronics and semiconductors have become the foundation of our modern world and economies.

Transformative impact of semiconductor on everything

Semiconductors have enabled most of the contemporary age technologies like 5G, IoT, AI, and others. AI has experienced unprecedented popularity and success in recent years and is considered the most critical technology of human evolution. We find AI applications in everything, from assisting us in crafting the perfect resume to solving complex problems in science & engineering. Generative AI today is transforming every industry. Although foundational AI algorithms such as ‘backpropagation’ and neural networks have existed for many years, they have not taken off because of limited computing and storage capacity. Simulating a simple neural network with just 500 nodes required a tiny supercomputer. However, the landscape has transformed dramatically over the years. The exponential growth in computational power and storage powered by semiconductors has been astonishing. Today, we can run very large language models (LLMs) with billions of parameters in seconds on our mobile phones—a task that would have taken a significant supercomputer decades ago. This quantum leap in semiconductor chips and storage has made AI successful, deployable, and accessible to various applications.

The growth in semiconductors and electronics has been the silent but indispensable driving force behind the success of AI, communication, electric vehicles, and other domains. What was once considered a computational challenge beyond reach is now a reality due to the strides made in these technological fields. Today’s computing power on mobile devices dwarfs what was available just a few years ago, demonstrating the monumental progress witnessed. These technologies have transformed daily lives and propelled AI and other applications to new heights, enabling it to harness its potential in previously unimaginable ways. The intertwined evolution of electronics, semiconductors, and AI showcases the power of human innovation and our ability to shape the future through technology.

Electronics: A thriving sector and manufacturing surge

India has seen remarkable growth and transformation in recent years. It is not just a nation with a burgeoning population of young and aspirational individuals but also a rapidly expanding market for electronics. The journey of India’s economic progress has been fascinating, and the evolution of its electronics industry is a pivotal part of this narrative.

India’s gross domestic product (GDP) reached the milestone of one trillion dollars ($1T) after nearly 67 years of independence. However, the subsequent years have witnessed an accelerated pace of economic growth. It took just seven years to reach the two-trillion-dollar mark ($2T) and another three years to accomplish the third trillion ($3T).

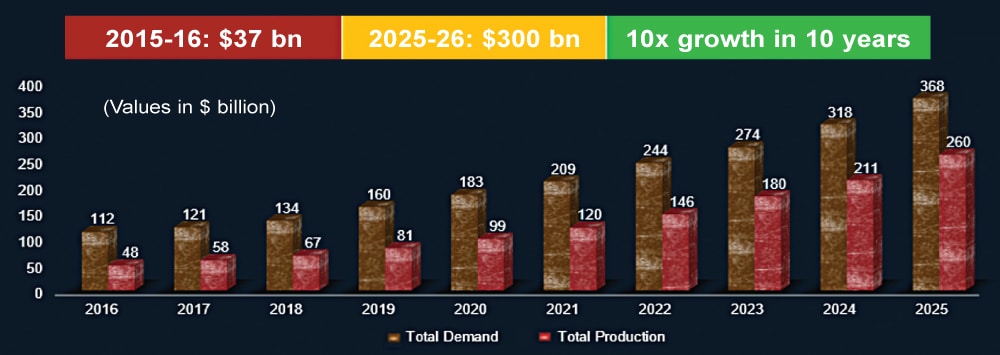

This growth reflects the dynamic nature of India’s economy. The electronics sector has been on a remarkable trajectory at the heart of this growth. The consumption of electronics in India is surging from $67 billion in 2015 to over $310 billion in 2026, making it one of the country’s fastest-growing sectors. This sector’s expansion is driven by the aspirations of the Indian population and their increasing appetite for electronic devices for various aspects of life.

Along with the market, India’s manufacturing capabilities in the electronics sector have grown significantly over the past decade. From a meagre $35-40 billion in 2015-16, the nation is now poised to reach the $300 billion mark for electronics manufacturing before the decade’s end with more than $100 billion in exports. India has done an excellent job creating large-scale manufacturing capabilities that are growing quickly.

While India may manufacture a substantial portion of electronics for domestic consumption and exports, global companies design and own many of these products. More than 90% of the manufacturing in India caters to global brands and companies, leaving domestic product design and ownership at less than 10%. This situation poses several challenges. First, when India does not design its products, it has limited control over the choice of components used in these devices. Foreign entities primarily make decisions about components, suppliers, and quality in their headquarters, limiting India’s influence in semiconductor purchases

For instance, consider the iPhone. While it may be manufactured in India, the crucial decisions regarding its components, such as processors, memory, and connectivity chips, are made by Apple in Cupertino and its suppliers in places like Shenzhen, China. On the economic side, manufacturing companies, including global giants like Foxconn and Indian manufacturing companies, earn a small fraction of the product’s value, less than 10%. At the same time, the product and brand owner reap significant economic value and profits of upwards of 30%.

India needs to convert its outstanding ‘M’arket potential, strong ‘M’anufacturing foundation, and abundance of quality ‘M’anpower to develop India-designed products and brands to harness the economic and strategic potential of the electronics sector. This shift will enable the country to retain more value in production, create jobs, and enhance financial security. Security is a critical concern, as a lack of control over product design can threaten data and national security.

Chinese dominance in Indian mobile market

Self-reliance in electronics requires manufacturing and owning the designs and products. By doing so, India can ensure that its electronics industry remains sustainable, resilient, and economically fruitful in the long run. Manufacturing is essential and foundational, but manufacturing alone is not enough for India to move up in the value chain; domestic products and product brands are crucial to self-reliance and the growth of the economy.

India’s journey to self-reliance in the global electronics industry is complex and multifaceted. It requires leveraging the ever-growing manufacturing infrastructure and making India a hub of product design and innovation. This transformation will bolster India’s economic prospects and enhance its security and global competitiveness. As the nation continues to grow and evolve, it must take steps to shape its destiny in the electronics sector and truly become self-reliant through a good share of domestic products and brands and the preferred destination for manufacturing global products and brands.

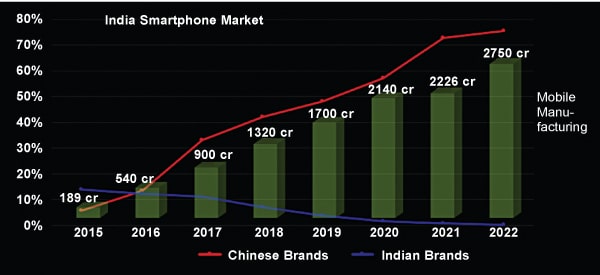

The success story of mobile phone manufacturing in India, the journey from 2015 to 2022, paints a compelling picture. The green line on the growth chart illustrates a remarkable transformation, as mobile manufacturing in India surged from 1.69 billion units to an impressive figure and continues to grow. However, while the numbers represent strong growth in manufacturing, a closer look reveals a nuanced story of the growing dominance of global brands, especially Chinese brands, and the need for Indian brands to reclaim their lost market share.

The red curve tells a story of its own. In 2015, Chinese smartphone brands held less than 2% of the Indian market share. Today, they command more than 75% of the Indian smartphone market. The rise of brands like Xiaomi, Oppo, Vivo, and OnePlus has been meteoric. These brands have captured the market and become household names in India.

Conversely, the market share of Indian brands like Micromax, Carbon, and Lava, represented by the blue line, has been decimated. In 2015, they held around 14% of the market, but today, they have less than 1% market share. This decline, while disheartening, underscores the challenges Indian companies face in a fiercely competitive market and presents a fantastic economic and strategic opportunity for domestic product and manufacturing companies to get a well-deserved market share of at least 25%.

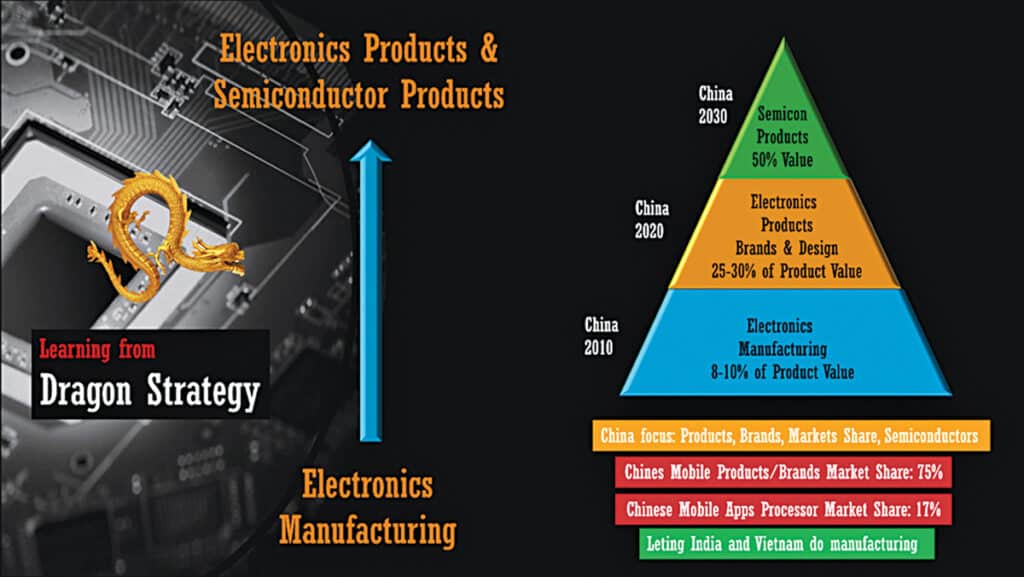

Lessons from China’s electronics and semiconductors growth

What can India learn from China’s trajectory in the electronics industry, which offers valuable insights? Initially, China focused on electronics manufacturing, catering to global demand just like where India is today. However, as they grew, they also learnt that technology created domestic ecosystems and skills to develop Chinese electronics products and brands. China strategically moved toward products that added substantial value, with about 30% value addition to products as the next stage in their evolution. With concentrated efforts in this direction by the policymakers and the industry, Chinese products and brands dominate most essential and high-volume electronics product categories.

Despite geopolitical hurdles limiting access to advanced semiconductor technology, China is advancing in creating essential chips like microcontrollers and power controllers for diverse electronics uses. Chinese firms gain supply chain control by developing alternatives to traditionally imported components. Increasingly, semiconductors in electronic devices are sourced from China, which is also progressing in manufacturing processors for phones, computers, servers, and AI and developing its semiconductor production capabilities.

A growing presence of Chinese chips in India

For instance, Chinese application processors from UNISOC and Hi-Silicon have made significant inroads into the Indian mobile phone market. Their market share has grown from zero to 10-15% in the last five years. Although it is currently used in low-end devices, it will move up and start challenging established players like Qualcomm, Samsung, and MediaTek soon.

In India, it is also important that we move from electronics manufacturing to electronics products and semiconductor chips. To chart a course similar to China’s, Indian brands must focus on owning product designs and components. Reclaiming ownership of the electronics landscape is crucial for long-term success and self-reliance. By shifting from being a manufacturing hub to creating and owning semiconductor components and manufacturing, India can assert its presence on the global stage.

From challenges to opportunity

In the ever-evolving landscape of India’s electronics industry, the intertwined and dependent entities of electronics products and semiconductor chips have come to the forefront, showcasing both challenges and opportunities. To better understand the situation, let’s examine the broader Indian market for electronics products.

Only around 10% of these products originate from Indian brands and companies. Global brands dominate the remaining 90%. For long-term sustainability and bringing in-depth manufacturing as a next step, this ratio needs a better balance for India’s self-reliance in electronics. On the semiconductor products front, more than 98% of the chips used in $180 billion of electronics products come from global companies and brands.

There is no doubt that in today’s interdependent world economy, global products and brands play a very crucial role, striving for an increased market share, particularly in terms of Indian products, Indian brands, and Indian design, is a well-deserved aspiration. It is estimated that the electronics market will grow to $400 billion before the end of this decade. Capturing a well-deserved 33% of the market share in electronics products, up from the current less than 10%, could unlock a market potential of $133 billion. Similarly, the semiconductor market will grow to $100 billion, and the 33% market share for Indian chips will unlock a $33 billion economic opportunity.

These numbers underscore the potential for India to make significant strides in the global electronics and semiconductor landscape. A host of sectors eagerly await India’s prowess in electronics and semiconductors. AI/ML, digital education, digital healthcare, fintech, telecom, transport, smart cities, data centres, and server domains rely heavily on these technologies.

Beyond market share and economic benefits, India’s cultural ethos offers a unique advantage—a commitment to sustainability and durability. Unlike the ‘use and throw’ culture seen worldwide recently, Indians tend to value and extend the life of their products. This presents an opportunity to create ‘reusable, re-pairable, and re-cyclable’ electronics products that align with the principles of a circular economy and sustainable growth. Transitioning from an electronics manufacturing hub to an electronics product nation, a global centre for innovation, design, and product ownership is the key to India’s success.

| The Government’s Initiatives |

| The Indian government has introduced several initiatives to bolster the semiconductor ecosystem. • Under the India Semiconductor Mission, semiconductor manufacturing facilities receive incentives to cover up to 50% of their costs on a Pari-passu basis. • Additional 20-25% incentives for semiconductor manufacturing by governments like Gujarat, Odisha, Uttar Pradesh, Tamil Nadu, Karnataka, and Telangana. • ‘Design Linked Incentives (DLI)’ scheme also part of FutureDesign Initiative, which offers incentives to semiconductor product companies and startups involved in chip design. This scheme covers 50% of project costs and provides access to EDA tools and resources, making chip design more accessible and affordable. • To address the talent gap, the government has implemented programmes such as ‘Chips to System’ (C2S), which aims to produce 175 ASICs, 30 SoC (system-on-chip) designs, and 30 IP (intellectual property) blocks and support more than 150 academic institutes. • A new B.Tech degree programme in electronics and VLSI (very large-scale integration) design has been approved by the All India Council for Technical Education (AICTE). This degree will pave the way for a more extensive pool of electronics and VLSI design professionals. So far, more than 130 institutes have signed up to offer the B.Tech degree in Electronics & VLSI Design. • ChipIn Centre at C-DAC and Future LABs initiatives to support all these initiatives. |

As we embark on this transformative journey, various domains beckon our attention. A few such bright spots for immense opportunities could be electric vehicles and drones. The automotive sector, for instance, offers opportunities beyond traditional OEMs, with subsystems and components ripe for indigenous design and manufacturing. Electric vehicles represent a promising frontier as they are the most electronic systems. Other than batteries, all other subsystems of electric vehicles are prime for Indian-designed products and manufacturing.

Drones, too, hold immense potential, especially with recent import restrictions. While the assembled drones may be imported, the electronics components like radio controllers, flight controllers, and sensors can be designed and manufactured locally.

Mapping India’s capability landscape

For India to succeed as an electronics and semiconductor product nation, a strong engineering and balanced workforce is a must. To ensure we have the right capabilities in all aspects of the electronics and semiconductor value chain, we must assess our current capabilities across the electronics and semiconductor ecosystem to gauge where India stands today.

As depicted in Fig. 4, we have a very good and growing market for electronics and semiconductor products and an excellent infrastructure for electronics manufacturing. Over the last three decades, strong capabilities have been developed for electronics systems design, semiconductor chip design, and embedded software design as a service to the global product companies.

For example, India has over 125,000 chip design engineers working for global semiconductor companies, and it is said that there is hardly any chip which does not have contributions from an Indian chip design engineer. Looking forward to domestic and global requirements, it is expected that India will need to produce at least 125,000 more chip design engineers in the next five years. Similarly, the talent must be developed for electronics products and system design.

With the right focus, India is poised to become a talented supplier to the world for the design and manufacturing of electronics products and semiconductor chips. The government of India has started multiple programmes to accelerate the pace of talent development in India.

| Suggested initiatives to make India an electronics and semiconductor product nation |

| • 1000 electronics products and 100 semiconductor chip domestic companies in next 5 years • PDLI (Product Design Linked Incentives) scheme for electronics product design with $500 million outlay, Similar to DLI scheme which was created for semiconductor chips • PLI incentives should be based on percentage of value addition. Higher value-added manufacturing should get a higher % of PLI incentives. A revision should be considered in the formula to calculate value addition • DLI and PDLI schemes should have seed funding mechanisms in addition to reimbursement mechanisms in the current DLI scheme. • Create strong infrastructure for product design, moulding, tooling, and enclosures, which is essential for modern electronics products. • Create a fund of $100 million/year for 5 years to support chip tape-outs by students |

Fostering a strong ecosystem for hardware startups in India

Fostering a dynamic ecosystem for hardware startups in the electronics and semiconductor sectors is pivotal for India’s ambition to lead in this key industry. Despite substantial achievements across various segments, electronics and semiconductor startups face significant challenges, contrasting sharply with the success of software startups over the past decade. These software enterprises have notably contributed to India’s digital public infrastructure, generating numerous unicorns and leading public firms. However, electronics and semiconductor ventures lag due to higher expenses, extended development times, scarce venture capital, and a lack of successful precedents.

Addressing these hurdles, the government of India introduced the Design Linked Incentive (DLI) scheme under its semiconductor policy. It offered robust support, including fiscal incentives covering 50% of project costs and complimentary access to premier design tools from leading EDA firms like Synopsys, Cadence, and Siemens. Additionally, states like Odisha augment these benefits with up to 20% extra fiscal incentives, pushing total support to 80-85% of project costs, alongside 4-6% PLI benefits on sales volume. This comprehensive support framework positions the DLI scheme as a globally unparalleled initiative to propel semiconductor startups to new heights of commercial and innovative success.

Electronics products provide a market for semiconductor chips, and the need of the hour is to provide similar incentives as DLI for domestic electronics product companies and startups to create a strong design and innovation ecosystem in this very critical sector. Ideally, 10% of money allocated for electronics and semiconductor manufacturing under the PLI and other schemes should be allocated as incentives for domestic electronics and semiconductor product companies and startups. Considering $10 billion has been allocated for electronics manufacturing under the PLI scheme, allocating $1 billion for design-linked incentives for electronics products and systems would be a game changer and help grow sustainable and high-value-added electronics manufacturing for domestic consumption and exports.

Creating a conducive environment for hardware startups in India is vital for achieving self-reliance and global competitiveness in the electronics and semiconductor industry. By re-balancing incentives, raising awareness, and providing mentorship and financial support, India can nurture a new generation of successful hardware startups and drive innovation in this critical sector. Leveraging organisations like VLSI Society of India (VSI), India Electronics and Semiconductor Association (IESA), ELCINA, STPI, and hundreds of incubators can be instrumental in bringing together stakeholders, fostering collaboration, and providing valuable support to the hardware startups for both semiconductor and electronics products.

Vision for self-reliance in electronics and semiconductors

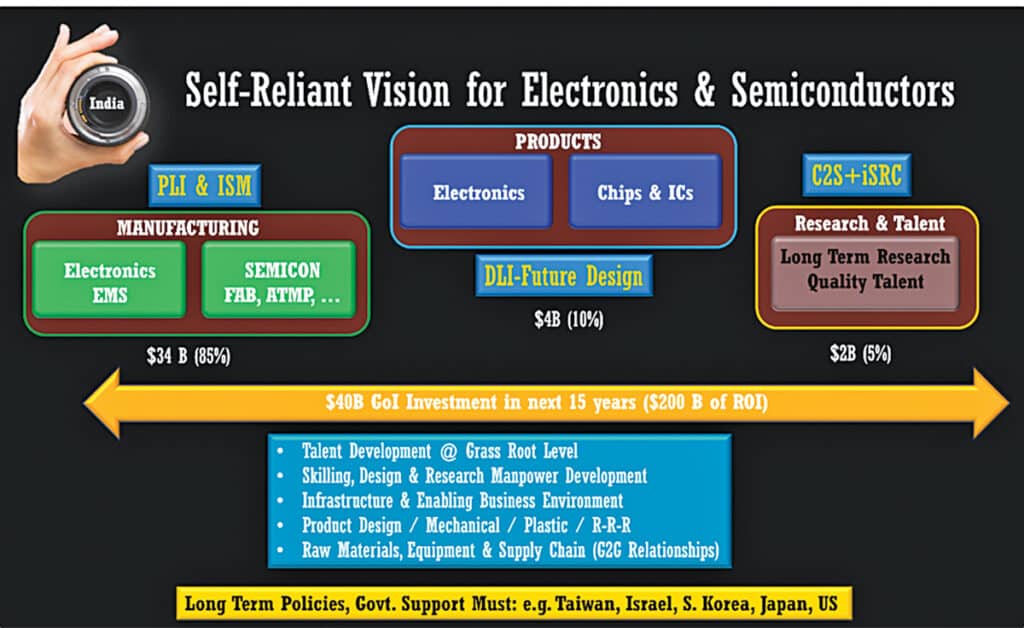

For India to become a self-reliant and globally competitive trusted partner in electronics and semiconductor supply chain, a balanced approach focusing on products, manufacturing, and talent development and research is needed. When we examine these three essential pillars, it is evident that significant strides have been made in manufacturing, especially in electronics manufacturing services (EMS) and contract manufacturing.

The Indian government has introduced schemes such as the Production-Linked Incentive (PLI) scheme for electronics manufacturing with almost $20 billion in incentives and the India Semiconductor Mission $10 billion for semiconductors for much needed semiconductor ecosystem. Electronics manufacturing, with strong support from PLI and other incentive schemes, has surpassed the $100 billion mark with more than $20 billion in exports and is expected to grow to $300 billion and $100 billion just in exports.

For semiconductor manufacturing, which is strategically critical, India Semiconductor Policy of 2022 has provided a good impetus. The government of India, many state governments, industry, academia, and many global Indians have put in outstanding efforts over the last 18-24 months and many projects, including that of Micron and Tata Group in semiconductors, are in various stages of planning, government approval, and execution.

India can say, “Mere paas MA hai,” fast-growing ‘MA’rket, globally competitive ‘MA’ nufacturing, and the large pool of talented ‘MA’npower. The long-term vision’s third and most critical pillar is ‘P’roducts. The Semiconductor DLI scheme is a good start in this direction. However, significant work is still needed for domestic electronics and semiconductor product design and brand creation to serve the solid domestic and global market, utilise and make the manufacturing ecosystem sustainable and leverage strong manpower.

India’s strategy has been manufacturing, and incentives are more tilted towards manufacturing. Providing incentives for product development equivalent to 10% of manufacturing incentives, or approximately $2 billion, will help create thousands of product companies, ODMs, OEMs, brands, and unicorns in the electronics and semiconductor field. Taking advantage of India’s strengths, a balanced focus on products, manufacturing, talent, R&D, and proportionate incentives will propel India to become ‘An Electronics and Semiconductor Product Nation.’

This article is based on a tech talk session at EFY Expo 2023, Delhi, by Dr Satya Gupta, President, VLSI Society of India, Intel Veteran, Founder Open-Silicon, EPIC Foundation and India Electronics and Semiconductor Association. It has been transcribed and curated by Akanksha Sondhi Gaur, Research Analyst and Journalist at EFY.