Every other day, the lunch table conversation steers into murky waters like cryptocurrencies and central bank digital currencies. Some are for it, some are against, very few admit that it is all very confusing, while in fact, it is! Enjoy your dessert, while we give you a simple, no-tension rundown of the digital currency scene.

For the past couple of years, the Reserve Bank of India (RBI) has held a firm stance against cryptocurrencies, which are volatile in nature, have the potential to cause financial instability, and enable under-the-radar transactions. There are serious discussions going on about banning them.

On the other hand, in this year’s budget, Finance Minister Nirmala Sitharaman announced that India would be launching its own central bank digital currency (CBDC) in the financial year 2022-23. She also went on to announce a 30% tax on gains made from any other private digital assets like non-fungible tokens and cryptocurrencies.

Does that mean the government has regularised cryptocurrencies? To understand these developments, we need to start from the ABC, and understand cryptocurrencies, CBDCs, and everything in between.

Digital currencies, definitely desirable

“Money has changed in form throughout history. Essentially, money is a trust device between users who agree on some intrinsic value for that ‘form’ and then use it as a store of value or to facilitate exchange. Anything that succeeds in gaining acceptance has the potential to become money or currency—from sea shells, pepper and gold to paper and digital. Digital, because the world is now a village, and with real-time global trade and exchanges between organisations, businesses, governments and now peer-to-peer growing exponentially, digital money is needed to facilitate these instantaneously. Digital money also serves an important purpose of compression of value (allowing for speedy movement and sometimes invisibility) that in the past art and gems have provided,” says Rajesh Lalwani, CEO, Scenario Consulting Pvt Ltd, preparing the ground for a discussion on this essential financial instrument!

Digital currency is an umbrella term, which refers to currency that exists in electronic form. It is stored, managed, and transacted through computer systems, other electronic devices, and wallets. Digital currencies do not have physical attributes, like notes or coins—though they may be equivalent to or convertible to fiat currency. There is no minting, storage, transportation, or other logistical processes associated with digital currency. Digital currency transactions are inexpensive and almost instantaneous. They enable seamless transfer of value—even across borders.

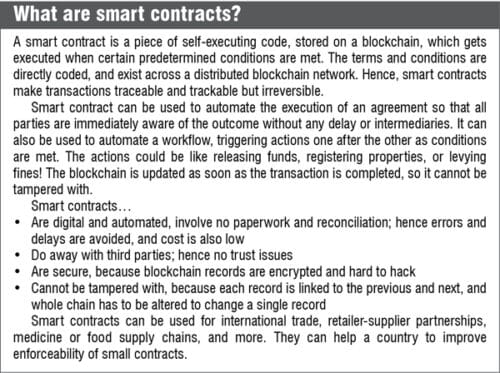

If the system is based on distributed ledger technology (DLT), each transaction is linked to the previous one and the next one in a distributed ledger. So, to change one transaction, you will have to change the entire chain. This ensures that all transactions are traceable but not reversible, making them very difficult to tamper with. All transactions are encrypted between digital wallets, resulting in exact parity calculation on the ledger. This instils a sense of trust in the system, reduces the possibility of errors, and the need for extensive reconciliation processes.

Given all the advantages, we have to remember that even the most robust and secure digital systems have fallen prey to hackers at some point of time. There have been rare cases of hackers stealing from wallets, or tampering with the protocol and making the currency unusable!

Overall, the concept of digital currency is definitely a desirable one, which can transform the world of finance. However, not all digital currencies are the same—and some can be very problematic too.

The many types of digital currency

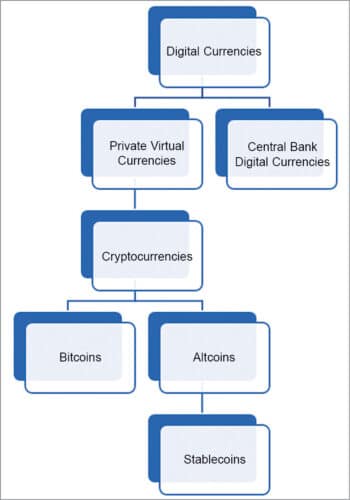

Digital currencies can be either open or closed, regulated or unregulated, centralised or decentralised—which gives rise to different categories: private virtual currencies, cryptocurrencies, and central bank digital currencies. We must first be able to differentiate between these, to discern which is better or worse.

Private virtual currency is mostly unregulated. It is issued and controlled by a private issuer, such as the developer or founding organisation of a platform, and not by a central bank. It is usually native to a network, and has little value outside of it. It can be algorithmically controlled. Transactions are usually direct, party to party, without intermediaries. It may be centralised or decentralised, may or may not be encrypted, and may or may not be convertible to fiat currency.

Cryptocurrency is a form of private virtual currency, which uses cryptography to manage and control the creation of currency, as well as to secure and verify transactions. This makes it difficult to counterfeit or double-spend cryptocurrencies. Cryptocurrencies are decentralised virtual currencies, which depend on blockchain networks to validate transactions and instil trust in the system. The most popular cryptocurrency is the Bitcoin, which was developed in 2008 by an unknown person or group by the name of Satoshi Nakamoto. Bitcoins are basically small pieces of code, given to reward mining—a compute-intensive process that verifies Bitcoin transactions on the blockchain.

Altcoins refer to all cryptocurrencies other than Bitcoin, such as Ether, Dogecoin, etc. These use cryptography too, but may use different logic to validate transactions or include advanced features to solve the inherent problems of Bitcoin such as volatility.

Stablecoins are a type of altcoin, which peg the value of the cryptocurrency to some physical entity like fiat currency, gems, or precious metals. This will act as a reserve to redeem holders if the cryptocurrency collapses. Price fluctuations are also limited to a narrow range. Examples of stablecoins include Tether’s USDT and MakerDAO’s DAI.

Central bank digital currencies (CBDCs) are regulated and centralised digital currencies, issued and managed by the central bank of a country. While the fiat currency is a paper contract, the CBDC is a digital legal tender. It supplements and coexists with traditional fiat currency, and is usually fungible with it.

Virtual currencies, real problems

According to CoinMarketCap, as of February 2022, there were 17,436 cryptocurrencies and 458 crypto exchanges. The market capitalisation of all cryptocurrencies stood at $1.98 trillion. Yet, regulators keep advising investors to beware of the risk in investing in cryptocurrencies, because they are extremely volatile in nature, and could lead to financial instability. Let us understand the risks that are inherent in

cryptocurrencies.

Cryptocurrency is just a piece of code, a decentralised digital asset, which is managed through a blockchain to ensure transparency and trust. It derives its value or purchasing power from its community of users—and can be used in the network (or virtual world) that it belongs to, to pay for services or digital assets like non-fungible tokens (NFTs).

Cryptocurrency is not backed by any central agency, and does not involve any intermediaries like banks or other financial institutions. It is basically driven entirely by free market forces, and is immune to government interference. For this reason, many call it ‘freedom money,’ describing it as a disruptive technology and a potential social movement.

The value of cryptocurrency is extremely volatile, and tends to change by the day, even by the hour. “Cryptocurrencies are all differently envisioned based upon their designed purpose and utility. Fluctuations in their prices are a function of demand and supply (real and manipulated) and the change in future value as buyers and sellers perceive it,” says Lalwani. Data from CoinMarketCap shows that the Bitcoin was valued at around $5000 in March 2020, rose to $65,000 by April 2021, and dropped to less than half that value by June 2021. This fluctuation was attributed to the novel coronavirus pandemic.

Similarly, Bitcoin valuations saw a steep fall after Russia’s attack on Ukraine. However, the prices bounded back soon thereafter, as investors’ risk appetite returned! In a speech delivered in February 2022, T. Rabi Shankar, Deputy Governor, RBI, explained that concentrated ownership in the hands of a few “crypto whales” makes the system prone to manipulation.

For something to be used as regular currency, its value should be reasonably stable. The highly volatile nature of cryptocurrencies means that you might not be able to use them to pay for your food, clothes, shelter, or other essentials! It is for this reason that Subash Chandra Garg, former Finance Secretary of India, commented in an interview last year that he preferred to call them just cryptos and not cryptocurrencies as they functioned only marginally as currencies, and will probably have to be recognised as another unique product or asset class in itself.

Another huge problem with cryptocurrencies is the complete privacy that it offers. In these decentralised blockchain based systems, the transactions are authorised by the participants and validated by the network without any intermediaries. A transaction remains anonymous in terms of people and purpose. A lot of misguided investors use this anonymity to evade government control and taxes. The ease of doing under-the-radar transactions also makes the crypto ecosystem an attractive playground for terrorists and money launderers.

Further, when investors put more and more money into cryptocurrencies, it could weaken a developing nation’s currency, since most of today’s cryptocurrencies are valued only in dollars and euros. Also, if people start doing cross-border transactions through private cryptocurrencies, a nation’s foreign exchange reserve would also go down. As more money goes into private currencies, the money circulating in the economy would go down. With multiple private currencies being used simultaneously, the government would lose policy control of the economy. Their ability to control inflation would be weakened. All of this could lead to financial instability.

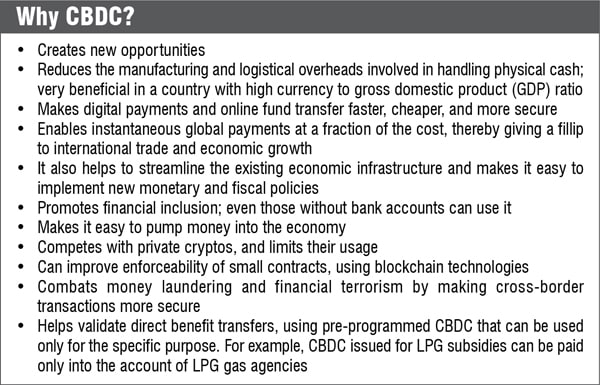

CBDCs overcoming the risk of crypto

While private, decentralised, and unregulated digital currencies are risky and troublesome, there is also the good side—regulated and centralised digital currencies could inject a lot of efficiency into a country’s payment mechanism. For this reason, governments across the world are in the process of launching their own central bank digital currencies. CBDCs offer the benefits of cryptocurrencies, sans the risk, because the respective country’s central bank would play its role as a regulatory and stabilising force.

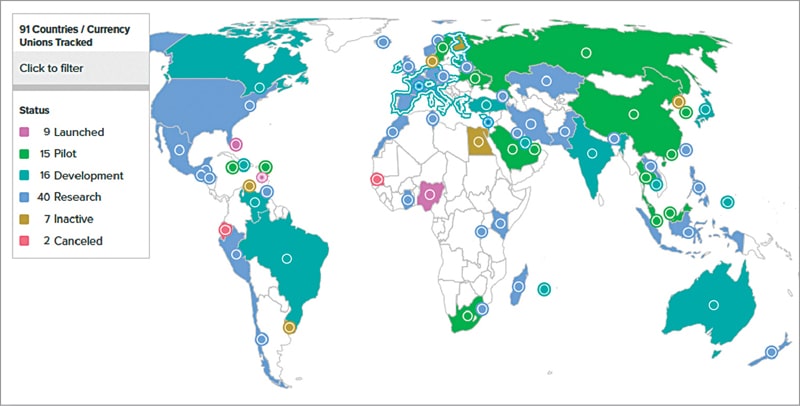

Nine countries, including The Bahamas and Nigeria, have launched their CBDCs, while fifteen, including Russia and China, are in the pilot stage. Sixteen countries, including India, are currently developing their CBDC framework. While announcing the upcoming digital rupee, Finance Minister said that its introduction will give a huge boost to the digital economy and will lead to a more efficient and cheaper currency management system.

“Central bank digital currencies are not to be confused with cryptocurrencies in that, while they may use encryption and may reside on the blockchain, they are backed by the respective central banks of sovereign states. They are the liability of the central bank and backed by the central bank assets just like the physical currency put into circulation by a central bank. Their unit value does not fluctuate. So, one rupee is valued at one rupee whether in cash or as a digital holding. In terms of exchange value to another central bank currency, say a dollar, that rupee’s value may change based on the various dynamics of foreign exchange valuation,” explains Lalwani.

Mihir Gandhi, Partner and Leader – Payments Transformation, PwC explains how CBDC could benefit a nation: “Features like trust, programmability, traceability, etc will impart additional benefits over physical form. Digital rupee will complement the existing payment modes and can make a significant impact in a few notable areas like offline payments, programmable or targeted payments (subsidies), cross border payments and remittances. Advantage is it is traceable, and lower-cost than physical currency to handle and manage, and interoperable with other digital currencies for international transactions.”

Does India need a CBDC?

As soon as the announcement about the digital rupee was made, debates exploded about whether India really needs a CBDC, considering that we already have a pretty advanced digital payment system—for both wholesale and retail payments. According to a CLSA report, digital payments in India rose from $61 billion in 2016 to $300 billion in 2021. It is expected to go up further to around $1 trillion by 2026. It is quite evident that people are comfortable with digital payment systems like United Payments Interface (UPI) and Immediate Payment Service (IMPS). So, the question arises as to why we need digital currencies.

In a November 2021 media interview, Garg explained that though more than 95% of payments by value are digital payments, there is about ₹30,000 billion of currency floating in the country, and it is believed that more than 90% of payments by volume are still physical payments. It is this segment of small-value currency transactions that needs CBDC the most.

“CBDC’s advantage is envisioned in terms of creating frictionless, accessible, and affordable payment mechanisms. While we have digital payment systems today, including immediate settlements through IMPS, UPI, etc, they are not universal and sometimes carry high fees or transaction costs (particularly cross-border). CBDCs will allow cross-border payments at fractional costs and deliver unprecedented impact,” says Lalwani.

Although the digital rupee is likely to advent in a very simple form, it will incorporate more features as time goes by.

Understanding retail and wholesale CBDCs

India is likely to introduce both retail and wholesale CBDCs.

Wholesale CBDC is for use by banks and other financial institutions. Wholesale payment systems in India are already digital and pretty well-evolved, so CBDC might not be visibly disruptive but will definitely introduce efficiencies using the blockchain. Wholesale CBDC will enable settlement on net basis. Settlements will be validated using smart contracts. It will be used for interbank, cross-border, capital, and security market settlements. It is rumoured that work on wholesale CBDCs is more advanced in India than retail CBDC.

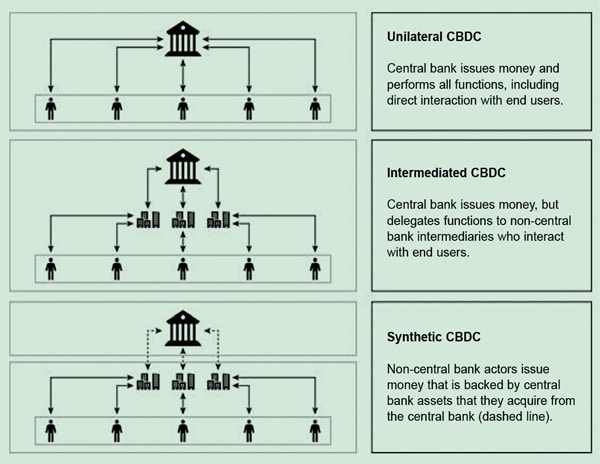

Retail CBDC is, understandably, more complex because it involves a larger population. It will be used by the general public for conducting day-to-day transactions, usually small-value ones. There are different conceptual operating models (refer Fig. 3), which decide how the CBDCs would flow through the economy, and what role banking and financial institutions, payment services, and application providers play in the ecosystem.

Blockchain and other technologies

India’s CBDC is likely to use DLT, most likely a private blockchain handled by the government. This would enable RBI to have good control over the blockchain. Sankar explained in his speech that a blockchain can be maintained without native currency, if transactions are authenticated centrally. It is possible to maintain accounts and reward work with legal tender currency too, making the DLT useful for several purposes without any private currency.

The iSPIRT Foundation earlier launched the Bharat Distributed Ledger (BADAL) for establishing trust for Indian B2B commerce. The BADAL protocol uses a private-public ledger (PPL) substrate, which might be useful for the RBI to launch CBDC.

Garg suggested in another media interview that it would be much easier, convenient, and cost-effective to dematerialise the physical currency on the lines of how equity, bonds, and other securities have been dematerialised, and use it to usher in digital currency in India.

According to Eswar Prasad, Professor at Cornell University, retail CBDC could take two forms—value based or token based. In a Bloomberg Quint interview, he said, “One could be a prepaid card, except it would be an account with a prepaid balance that you would have on your phone. A second form is where a CBDC essentially functions as a token in a payment system. This would take the form of a digital wallet where one could hold CBDCs, which would essentially be like accounts, but non-interest-bearing accounts.”

“Blockchain is one of the many distributed ledger technologies available for launching a CBDC, however not the only technology available. We will need to evaluate available technologies on multiple criteria like accessibility, privacy, scalability, performance, resiliency, finality etc. Decision needs to be taken based on the model selected, if there should be a centralised technology or decentralised technology,” concludes Gandhi.

Pitfalls to be avoided

While designing its CBDC framework, India must take into consideration some potential problems, and try to design the solutions into the system right in the beginning:

Potential bank run

A bulk shift from commercial to central banks might lead to a kind of financial crisis. To avoid this, central banks must limit the amount of money that can be held in CBDC accounts, and make sure digital wallets are maintained by commercial banks.

Strain on the central bank

Full control in the hands of central banks might lead to a strain on their network infrastructure and make the central bank vulnerable to security threats.

Private innovation

Reduced role of commercial banks might kill private innovation in the banking sector. To avoid this, countries like Sweden and China are trying out a two-tier CBDC, where the central bank provides the payment infrastructure in the backend. In the front-end, commercial banks innovate and provide effective payment mechanisms to users.

Policy making challenges

CBDC, with the direct nature of its transactions, will have a dynamic impact on the economy, and macroeconomic policymaking will be more challenging than ever before!

Energy consumption

Blockchain based cryptographic networks require immense computing power, and many of them, including the Bitcoin network, have come under heavy criticism for their socially wasteful energy usage. However, high energy consumption is not intrinsic to all blockchain network architectures. The amount of energy consumed by a blockchain network depends on its consensus mechanism, that is, what information is added to the network ledger. India must optimise this, such that it does not have a deep environmental impact.

India is in for a very interesting ride, which involves not only designing and developing the infrastructure, and rolling out the digital currency in a phased manner, but also clearing misconceptions and creating awareness about digital currencies—what is accepted and what is not. We might see wholesale CBDC in action first, followed by retail CBDC in a simple form, with more features being added as we go along.

Janani G. Vikram is a freelance writer based in Chennai, who loves to write on emerging technologies and Indian culture. She believes in relishing every moment of life, as happy memories are the best savings for the future