While lack of reliable grid power was a driver for traditional energy storage systems, ambitious renewable energy goals, growth in electric vehicle sales, and need for reduction in diesel usage will boost the sales of energy storage systems throughout the country

Energy storage systems are essential for large renewable energy systems to provide a clean, resilient energy supply through local generation. The technology continues to prove its value to grid operators around the world, who must manage the variable generation of solar and wind energy.

Several studies predict a considerable near-term potential for stationary energy storage as its costs are falling. In fact, its cost could reduce to $200 per kilowatt-hour (half the current price) in 2020 and $160 per kilowatt-hour or less in 2025.

Besides, identifying the most economical projects and highest-potential customers for storage has become a priority for a diverse set of companies including power suppliers, grid operators, battery manufacturers, energy-storage integrators, and businesses having established relationships with prospective customers such as solar developers and energy-service companies. According to McKinsey, the global opportunity for storage could reach 1000GW in the next 20 years as the technology matures.

Indian scenario

India is one of the fastest growing economies in the world. However, its annual per capita energy consumption of around 1222kWh is far below the level in other developing countries like Brazil and China. Therefore India needs a clean energy revolution in order to provide energy access to its 240 million households that still lack this basic facility.

Moreover, urban middle-class population of the country, exceeding 250 million, aspires for the same level of energy access and power quality as in developed countries through movements like Smart Cities and sustainable living.

Lack of reliable and quality power supply is a major obstacle to the development of manufacturing and industrial sector in India. Industries rely on diesel-powered generators, while households use inverters with batteries to deal with unscheduled power cuts, low voltages or variable frequency.

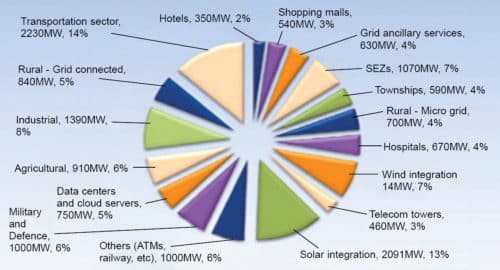

Given this scenario, energy storage systems can play a key role across all segments in India. India Energy Storage Alliance (IESA) estimates the Indian energy storage market to reach 16,445MW by 2020 (Fig. 1) and further up to 70GW by 2022. This huge market potential will attract huge investment.

India has the potential to not only become one of the largest markets for advanced energy storage technologies but also a global hub for manufacturing various energy storage technologies due to an attractive domestic market and strengthening of business environment. With Make in India programme, the government of India aims to encourage various technology developers to set up their manufacturing base in India. Although India missed the opportunity to set up mainstream manufacturing for solar, energy storage is an upcoming industry where Indian manufacturers can play a key role in the global supply chain.

Market dynamics

India’s energy storage potential is based on the combination of energy resources, historical physical infrastructure and electricity market structure, regulatory framework, population demographics, energy-demand patterns and trends, and general grid architecture and condition. The performance of these fundamental factors creates the demand for new products and services, and energy storage is increasingly being sought to meet these emerging requirements.

The Indian energy storage providers are gearing up with large-scale pilot projects. While lack of reliable grid power was a driver for traditional energy storage systems, ambitious renewable energy goals, growth in electric vehicle sales, and need for reduction in diesel usage will boost the sales of energy storage systems throughout the country. The government of India has set up 175GW target for renewable energy deployment by 2022, and it is evident that energy storage technologies will play a key role in achieving this goal.

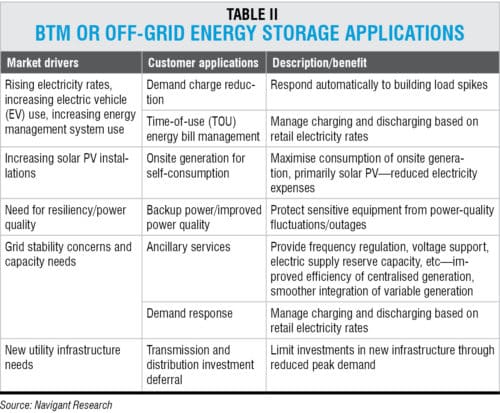

While specific drivers for energy storage markets vary with time, the overall market can be bucketed under three major segments:

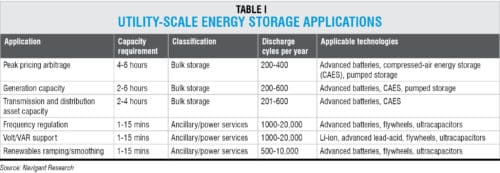

1. Utility-scale or grid-tied applications refer to systems installed on transmission or distribution networks providing services to grid operators (Table I)

2. Off-grid applications covering behind-the-meter (BTM) systems are installed at the customer side of a utility meter and primarily help reduce costs and improve resiliency for commercial and industrial (C&I) or residential customers (Table II)

3. Remote power systems refer to storage systems operating as part of isolated electricity networks

Remote power systems are still a niche segment compared to grid-tied and off-grid applications.

Grid-tied scenario

Key applications at grid scale include provision of fast-response ancillary services such as frequency regulation, renewable ramp rate control, smoothening and firming up of renewable power as well as optimisation of transmission and distribution investments. Both policymakers and industry stakeholders are taking active steps in exploring energy storage integration in India.Major policy boosts by Ministry of New and Renewable Energy (MNRE) and Power Grid Corporation of India Ltd (PGCIL) have opened doors to grid-tied energy storage deployment for ancillary services and renewable energy integration in India.

Telecom Regulatory Authority of India (TRAI) has mandated the use of renewable power for telecom towers in India; currently, these towers use diesel power as the primary source of energy. These policy initiatives have resulted in tremendous opportunities for integration of energy storage technologies in a variety of applications. Immediate applications range from telecom tower backups to grid ancillary services and renewable integration.

Off-grid opportunities

Need for electrification and insufficient power supply are one of the primary growth drivers for the off-grid energy storage market in India. Electricity consumption is imperative for economic growth, driving infrastructure and social development. Grid extension has a high operational cost and demands high investment. Consequently, in remote areas with limited grid connectivity, diesel generators and energy storage systems play a crucial role.

Technavio research estimates the off-grid energy market to grow steadily at a CAGR of more than 15 per cent by 2021.

The cost of diesel is higher in remote locations due to the added high cost of transportation. In the process of burning the diesel, diesel engines make noise and emit carbon into the atmosphere. Solar photovoltaic (PV) systems produce clean and renewable solar power while creating minimal noise during operation. The operating time of diesel generators can be reduced significantly by hybridising power systems, which will consequently reduce CO2 emissions. According to Technavio study, demand for CO2 emission reductions will gain traction in India’s off-grid energy storage market.

The off-grid energy storage market in India is highly fragmented due to the presence of a large number of international, regional and local vendors. There will be fierce competition between big vendors offering advanced and differentiated products and smaller vendors offering high quality at lower prices.

Based on end use, the off-grid energy storage market in India can be segmented as residential and non-residential.

Majority of the population residing in India has limited access to grid power, which encourages consumers to adopt off-grid energy solutions such as solar home systems. For remote locations, solar home systems are economically viable and highly suitable to meet the growing demand for power, contributing to the growth of residential solar energy storage market.

Electric vehicles to drive energy storage

India has launched a National Mission on Electric Mobility with a target of six million electric vehicles (four million two-wheelers and two million four-wheelers) by 2020. An Efficient rollout of the EV programme requires electrical distribution infrastructure upgrades and smarter systems to control/limit simultaneous charging of hundreds of EVs from the same feeder.

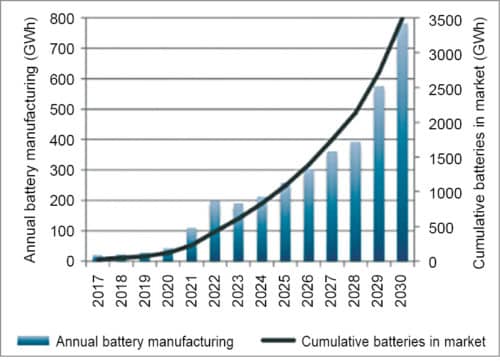

Further, India’s aspiration to achieve 100 per cent electric vehicle (EV) sales by 2030 will drive up its rank among the top countries manufacturing batteries. However, this will require a strategy to overcome India’s relatively weak initial position in battery manufacturing while claiming an increasing share of total battery value over time. India’s EV battery market alone could be worth as much as $300 billion from 2017 to 2030. The country could represent more than one-third of global EV battery demand by 2030, provided it meets the goal of a rapid transition to shared, connected and electric mobility (Fig. 2).

Since battery accounts for about one-third of the total purchase price of an EV, driving down battery costs by rapidly scaling up production and standardising battery components could be the key to long-term success for India’s automotive sector. In fact, India’s EV mission could drive down global battery prices by as much as 16 per cent to $60 per kWh.

Immediate policy-level support is needed to build the enabling infrastructure for integration of EVs in the electrical network so that these millions of EVs connected to the power system can be leveraged as virtual power plants that store surplus energy generated and support the grid during moments of deficit. Globally, Vehicle to Grid (V2G) technologies are evolving rapidly to achieve these objectives.

Batteries in demand

Electrochemical storage technology, primarily driven by secondary batteries (lead-acid and lithium-ion), captures a major share of the Indian energy storage market. Lead-acid batteries can be segmented into flooded batteries (used in deep-cycle applications) and VRLA batteries (suitable for standby power with low depth-of-discharge characteristics). Advances in related technology to increase battery life-cycle, charge acceptance, efficiency and discharge performance, as well as low upfront costs will influence the growth of lead-acid battery segment.

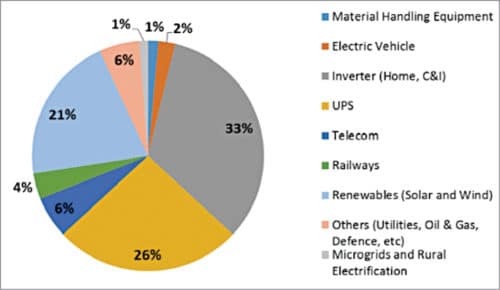

IESA forecasts the lead-acid battery market size to reach around US$ 4 billion by 2020, representing CAGR of 13 per cent for the period 2015-20 (Fig. 3). Currently, inverter and UPS applications take a major share (60 per cent) of the stationary and motive battery market. In coming years, home inverter market growth will stagnate at 7-8 per cent due to improved power scenario and use of common power backup in new townships and societies of urban areas.

Increased automation in C&I segment with scattered locations of IT offices and data centres in Tier 2 and Tier 3 cities makes use of UPS mandatory in India. This will lead to a healthy growth (10-15 per cent) in this segment.

Renewable integration, especially solar PV and wind, as well as the government’s thrust on electric vehicles (EV) and e-rickshaws already make this market very attractive.

Telecom is another promising segment for battery use, but newer technologies like Li-ion and flow batteries are giving tough competition to use of lead-acid batteries for telecom towers. Expansion of the railway network, the ambitious target of metro trains and an introduction of bullet trains make railways an attractive segment with growth prospect of 4 per cent for lead-acid battery manufacturers.

In India, Li-ion batteries are emerging as an environment-friendly, rechargeable power source in comparison to conventional lead-acid, nickel-cadmium and nickel-metal-hydride batteries. These are increasingly being used in consumer electronics products (such as smartphones and tablets) and healthcare equipment (like surgical devices and respirators). With continuing technological developments, Li-ion batteries are also being used in the automotive industry, particularly in electric vehicles. However, in the absence of proper domestic manufacturing, Indian manufacturers need to import Li-ion batteries from other Asian countries like China, Taiwan and South Korea.

According to a TechSci report, the Li-ion batteries market in India will witness double-digit growth at over 35 per cent annually till 2020. The government’s efforts to minimise carbon emissions and toxicity level in the environment are likely to drive the adoption of Li-ion batteries across major end-use industries including consumer electronics and automotive.

In addition, the government has announced tax exemption on electric vehicles powered by Li-ion batteries, which is anticipated to drive the market further. Owing to their compact size, lightweight and high durability, Li-ion batteries are expected to witness wider adoption in telecom and data communication applications as well as energy storage systems.