Engine control unit, EV/HV, HVAC, infotainment, and lighting account for 95% of the automotive electronics demand in the country. Government initiatives, such as the Automotive Mission Plan, which aims to produce 940 million vehicles by FY26, are expected to generate significant demand for automotive electronics over the next five years. According to Frost & Sullivan, the Indian automotive electronics market has the potential to generate revenue of $9.2 billion by 2025

The automotive industry in India is transforming because of its sustained growth and profitability. Indian automotive industry currently accounts for 7.1% of GDP and 49% of manufacturing output, generating 32 million direct or indirect employments. Based on the Automotive Mission Plan 2019-2026, a collective vision of the government of India and the Indian automotive industry, the sector is expected to employ 36 million people by 2026, according to the Automotive Skill Development Council.

The industry has made a strong recovery in CY2021, with the passenger vehicle segment registering a record 26% Y-O-Y growth, as per the Society of Indian Automobile Manufacturers. The Indian automotive market, particularly the passenger vehicle segment, is expected to grow at a CAGR of 10% to 12% (as per CRISIL) over the next five years. This will be driven by increasing urbanisation, higher disposable income, expanding domestic customer base, favourable demographics, supportive infrastructure, and increased foreign investment.

The landscape of the Indian automotive industry is changing rapidly with emerging business models and trends, such as connected, autonomous, shared, and electric (CASE). Technologies that support the shift toward connected, autonomous, and electric vehicles, along with customer-centric parameters, such as user experience and infotainment, are expected to boost the demand for automotive electronics in the coming years.

The landscape of the Indian automotive industry is changing rapidly with emerging business models and trends, such as connected, autonomous, shared, and electric (CASE). Technologies that support the shift toward connected, autonomous, and electric vehicles, along with customer-centric parameters, such as user experience and infotainment, are expected to boost the demand for automotive electronics in the coming years.

According to Frost & Sullivan, the Indian automotive electronics market has the potential to generate revenue of $9.2 billion by 2025. Body control module (BCM), anti-lock braking system (ABS), in-care entertainment system (ICES), tire pressure monitoring system (TPMS), telematics, and battery management system (BMS) are some of the prominent technologies that will drive this market. About 65 to 70% of India’s demand for automotive electronics is currently met through imports.

Various measures and policy incentives have been announced in recent years to boost the domestic electronics system design and manufacturing (ESDM) and strengthen the domestic automotive electronics manufacturing ecosystem. Customer expectations, regulations, and evolving mobility infrastructure are the drivers.

Evolving customer expectations

Indian automotive industry continues to evolve with increasing customer expectations from products, price sensitivity, shorter product life cycles, frequent changes in product ownership, focus on safety and entertainment features, and personalised experiences. Next-generation digital solutions will play a pivotal role in this transformation, which will drive the automotive electronics business.

Regulatory interventions

India’s vehicle safety standards have improved noticeably in recent years with next-gen technologies, such as the advanced driver assistance system (ADAS), expected to be introduced soon. Government safety standards, such as AIS 145, the adoption of telematics systems, and consumer demand for safer vehicles, will act as a catalyst for increased adoption of automotive electronics in India in the future, with estimates indicating that safety, ADAS, and infotainment will account for 60% of this demand.

Changing face of mobility infrastructure

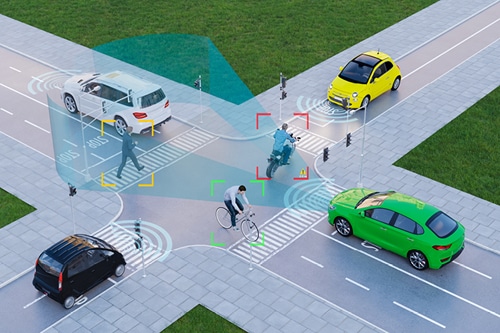

Technologies like self-driving vehicles revolutionise the mobility sector. The development of alternative means of transportation and smart infrastructure (smart cities, parking optimisation, AI-driven traffic lights, and enabling EV-charging infrastructure) is expected to transform India’s mobility infrastructure and generate the business potential for automotive electronics industry.

Next-gen technologies

Multiple next-gen technologies will be commercialised over the next 4-5 years. The passenger vehicles segment is expected to contribute two-thirds revenue of the Indian automotive electronics market. This would be driven by the increasing usage of the telematics control unit (TCU), infotainment, electronic control unit (ECU), onboard diagnostics (OBD), and anti-lock braking system (ABS). Head-up display (HUD), blind-spot detection, advanced driver assistance systems (ADAS), auto-dimming mirror, and automatic transmission features will remain mainstream for the premium segment cars.

Advancements in electronics for various vehicle components will require the installation of electronic control and communication systems. Advanced electronic systems should be directed to operate active safety features like dual airbags, electronic stability control, advanced braking systems, and tire pressure monitoring systems. Stringent regulations, such as Corporate Average Fuel Efficiency II and Bharat Stage-VI, are also significant drivers of the rising electronic content in a car. The government’s focus on promoting electric mobility through various policy measures will propel the demand for automotive electronics in the coming years.

![]() The Internet of Things (IoT) would be crucial for vehicle connectivity. The connected vehicles capable of communicating with the surrounding environment will lead to the emergence of new-age business opportunities through connected data. These enabling technologies for futuristic vehicles will be commercially available in the next 4-5 years.

The Internet of Things (IoT) would be crucial for vehicle connectivity. The connected vehicles capable of communicating with the surrounding environment will lead to the emergence of new-age business opportunities through connected data. These enabling technologies for futuristic vehicles will be commercially available in the next 4-5 years.

The two-wheeler segment will also witness increased adoption of electronics in the future. The three-wheeler segment is a laggard in the adoption of electronics. Embedded telematics and infotainment offerings are occasional in the three-wheelers category and are expected to remain the same over the short to medium term.

Domestic capacity building

Domestic capacity building would be a key to tapping this potential. Indian suppliers have built a strong capability in hardware manufacturing, forging, and machining of the components but are comparatively new in electronics design and manufacturing. As a result, majority of the demand for automotive electronics is met through imports, primarily from China, Taiwan, and Korea.

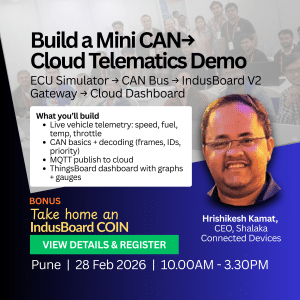

The top five products, namely, engine control unit (ECU), EV/HV, HVAC, infotainment, and lighting, account for 95% of the automotive electronics demand in the country, according to Frost & Sullivan’s analysis. Government initiatives, such as the Automotive Mission Plan, which aims to produce 940 million vehicles by FY26, are expected to generate significant demand for automotive electronics over the next five years.

The National Policy on Electronics (NPE 2019) aims to position India as a global hub for electronics system design and manufacturing (ESDM) by encouraging and driving country capabilities to develop core components, including chipsets, and create an enabling environment for the industry to compete globally. The NPE 2019 also envisions the creation of a vibrant and dynamic semiconductor design ecosystem in the country by incentivising the start-ups and making design infrastructure accessible to them.

Towards this, the government has promoted the entire ecosystem of the Indian electronics industry through incentive schemes. Incentive support is being provided to companies/consortia that are engaged in silicon semiconductor fabs, display fabs and compound semiconductors/silicon photonics/sensors (including MEMS), fabs semiconductor packaging (ATMP/OSAT) and semiconductor design (design linked incentive or DLI).

Towards this, the government has promoted the entire ecosystem of the Indian electronics industry through incentive schemes. Incentive support is being provided to companies/consortia that are engaged in silicon semiconductor fabs, display fabs and compound semiconductors/silicon photonics/sensors (including MEMS), fabs semiconductor packaging (ATMP/OSAT) and semiconductor design (design linked incentive or DLI).

PLI for IT hardware and large scale electronics

Production linked incentive (PLI) schemes will boost investment in the entire value chain of the Indian electronics industry, including designing, ensuring local availability of components (ICs, chipsets, systems on chip, systems or IP cores, etc), and make Indian electronics industry more self-reliant and export-oriented. Developing the local manufacturing ecosystem will strengthen the local supply chain, thereby improving time to market, reducing lead times, saving precious foreign exchange, reducing component and logistics costs, and making electronics products more affordable in the coming years.

Electronics manufacturers can now focus on improving capabilities in such areas as PCB manufacturing techniques, SMT based automated production lines, ESD precautions in handling electronic components, in-circuit testing procedures, and PLC based automated techniques, to name a few. Additionally, Indian manufacturers need to build superior capability in hardware design, testing, software integration, in-vehicle networking, and Simulink tools for creating and simulating interface systems.

Rudranil Roysharma is Director, Energy & Environment Practice at Frost & Sullivan