A web search for ‘non-fungible token’ or NFT throws back endless news about limited-edition virtual sneakers, digital art, memes, tweets, and trading cards being sold for unrealistic prices. But NFT means much more. It is serious tech with extremely great potential in the digital and physical worlds. Here is what you need to know about NFTs and their applications

A non-fungible token (NFT) of Chris Torres’ Nyan Cat, a video of a flying cat with a pop tart body leaving behind a rainbow trail, sold for $580,000, while Everyday: The First 5000 Days, a collage of 5000 digital images by Mike Winkelmann, sold for $69 million. A 21-year-old Dutch student recently put up his soul for sale as an NFT, and at the time of writing this article its price had crossed $3.4 million. Closer home, four Thar based NFTs auctioned by Mahindra & Mahindra in March 2022 sold for a sum of `26,00,000!

Seeing these examples, one may be fooled into thinking non-fungible tokens or NFTs are all about people burning cash in collectibles and memorabilia. However, NFT as a technology means much more, and can potentially be used for many more real applications that can affect our daily lives, including medical record maintenance, improving supply chain efficiency, industrial design prototyping, and protecting intellectual property (IP). It can be a very effective way of digitising real-world objects and processes.

Let us take a quick look at what NFTs are, a deeper look at their role in the art, collectibles and memorabilia space, and about other uses they can be applied to.

What is an NFT?

A non-fungible token or NFT is a unit of data stored on a digital ledger, such as the blockchain. It is also a crypto-token like digital currency, but here the unit of data is associated with a particular digital or physical asset—say, a file, a work of art, a degree certificate. The data is used to give important information about the asset, such as the creator’s signature, current ownership, history, and terms of use or license.

Let us take a look at its characteristics.

It is non-fungible. Cryptocurrencies like Bitcoin or Ether are fungible tokens. That is, if you take two Bitcoins, they represent the exact same value, which makes them interchangeable or fungible. On the other hand, NFTs represent assets that are rare and unique, and not replaceable by one another, which makes them non-fungible.

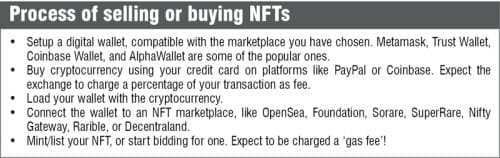

It is tradeable. You can sell or trade NFTs in digital marketplaces, such as OpenSea, Foundation, Sorare, or Decentraland, using supported digital currencies stored in digital wallets.

It is immutable. Once an NFT has been encoded using blockchain technology, you cannot alter the metadata, ownership information, or history. A blockchain is a decentralised mechanism, open to scrutiny. This makes an NFT a trustable certificate of uniqueness and ownership.

It is immutable. Once an NFT has been encoded using blockchain technology, you cannot alter the metadata, ownership information, or history. A blockchain is a decentralised mechanism, open to scrutiny. This makes an NFT a trustable certificate of uniqueness and ownership.

It is verifiable. Not only is an NFT immutable, it is also verifiable. That is what makes it so special. At any point of time, you can quickly and easily verify the authenticity and ownership history of an asset using a block explorer for that specific blockchain, such as Etherscan for Ethereum and PolyScan for Polygon.

It is interoperable. Technically, NFTs can be traded across online platforms, wallets, and marketplaces because of the open nature of blockchain standards.

It can use any blockchain. Today, most NFTs are programmed using Ethereum standards, though technically they can be based on any blockchain like Algorand, Tezos, or Polkadot.

This ability to record and validate digital creations, and to digitise real-world objects, makes NFTs a force to reckon with in the emerging metaverse that aims to integrate real and online experiences, using extended reality tools and the Web3 paradigms of decentralisation and token based economics.

This ability to record and validate digital creations, and to digitise real-world objects, makes NFTs a force to reckon with in the emerging metaverse that aims to integrate real and online experiences, using extended reality tools and the Web3 paradigms of decentralisation and token based economics.

2014 to 2021—a quick recap

The first-known NFT was a small video clip called Quantum, which was registered on the Namecoin blockchain in 2014 and sold for $4. It was a small experiment by techie Anil Dash and artist Kevin McCoy, who paired at an event for sparking new ideas. The duo termed it as monetised graphics.

“McCoy used a blockchain called Namecoin to register a video clip that his wife had previously made, and I bought it with the four bucks in my wallet. We didn’t patent the basic idea, but for a few years McCoy tried to popularise it, with limited success. Our first demo might just have been ahead of its time. The system of verifiably unique digital artworks that we demonstrated that day in 2014 is now making headlines in the form of non-fungible tokens, or NFTs, and it’s the basis of a billion-dollar market,” wrote Dash in The Atlantic.

In October 2015, the first NFT project Etheria was launched at Ethereum’s first developer conference. They released 457 purchasable, tradeable hexagonal tiles. Most remained unsold.

In 2017, the online game CryptoKitties started selling tradeable cat NFTs. It became so popular that it temporarily slowed down the Ethereum network! “CryptoKitties has become so popular that it’s taking up a significant amount of available space for transactions on the Ethereum platform,” says Garrick Hileman of the University of Cambridge in a 2017 BBC News report. “Some people are concerned that a frivolous game is now going to be crowding out more serious, significant-seeming business uses.” However, you will not find the term NFT in any of the news reports of that time!

The term NFT became popular only after the advent of the Ethereum based ERC 721 (Ethereum Request for Comments 721) standard in 2018. ERC 721 implements an application-programming interface (API) for tokens within smart contracts. It ensures the uniqueness or non-fungibility of tokens and adds more functionalities to know the owner of a specific token, transfer tokens from one account to another, and so on.

NFTs slowly picked up steam, and several NFTs and in-game assets were sold in platforms like Decentraland and Gods Unchained. In the first three months of 2021, more than $200 million was spent on NFTs. NFTs caught the attention of the art world, when a digital art by Mike Winkelmann or Beeple sold at a Christie’s auction for more than $69 million in March 2021. In the same month, Ethereum relaunched the unsold tiles of 2015, and they sold within 24 hours for a total of $1.4 million. In August 2021, Jack Dorsey, co-founder of Twitter, sold an NFT of his first tweet—‘just setting up twttr’—for $2.9 million. In December 2021, digital artist Pak’s The Merge fetched $91.8 million on Nifty Gateway!

Auction houses started tying up with digital artists, celebrities started making NFTs of their milestones and memories, sports leagues started launching NFT based trading cards embedded with top shots and historic moments, and companies ranging from fashion to food started launching themed NFT collectibles.

NFTs became so popular in 2021 that many experts found it a bit crazy! Some connected it to the boom in cryptocurrencies at that time. The price of cryptocurrencies skyrocketed in the first quarter of 2021. The price of Ether skyrocketed more than 1000% year on year, and that of Bitcoin rose more than 600%. This meant major returns for early crypto-buyers, which they started investing in digital assets. The Beeple, for example, was bought by Vignesh Sundaresan aka Metakovan, and Anand Venkateswaran aka Twobadour, two South Indian crypto-billionaires based in Singapore.

A few analysts even attributed the NFT trend to the Boredom Markets Hypothesis. The theory, proposed by lawyer and Bloomberg columnist Matt Levine in 2020, says that people will buy stocks when buying stocks is more fun than other things they could be doing for fun. So, many experts thought that since many missed their usual fun activities during the 2021 lockdown, they resorted to trading intangibles. Most predicted that the bubble would burst once people got back to their usual activities. But it does not seem to be so; NFTs are still on a bullish run!

A few analysts even attributed the NFT trend to the Boredom Markets Hypothesis. The theory, proposed by lawyer and Bloomberg columnist Matt Levine in 2020, says that people will buy stocks when buying stocks is more fun than other things they could be doing for fun. So, many experts thought that since many missed their usual fun activities during the 2021 lockdown, they resorted to trading intangibles. Most predicted that the bubble would burst once people got back to their usual activities. But it does not seem to be so; NFTs are still on a bullish run!

Shaking up the art world

Considering that it is art that threw NFTs into the limelight, we think this demands some special attention before we delve into other segments of NFTs.

Digital art. NFTs offer a great way to monetise digital art. Artists can mint NFTs of their digital art and sell them on digital marketplaces. They can engage directly with their fans on social media and create enough awareness (or hype) about the NFT to ensure it sells when launched. International art dealer, Stephen Howes of Thomas Crown Art, remarked in a recent press release on NFTs, “It allows artists to make some money and exercise control over their work, to sell it more easily, reach a global audience, to more strongly protect against others appropriating it without permission, and sidestep the traditional biases of the ‘art industry mafia’.”

There have been stories of people who made their fortune through NFTs. Robness, popularly known for his trash can art, was living out of his car and doing odd jobs when he started dabbling in the crypto world in 2014. He is now an NFT artist, with projects hosted across many marketplaces. His NFTs depict many elements of modern life—including trash cans, and an application he made to McDonalds! Most notable is his 64 Gallon Toter, an NFT made from a photo of a trash can, which sold for $252,000 on OpenSea, and is currently valued at around $80,848,305.

Not ones to miss the trend, leading auctioneers like Christie’s and Sotheby’s have also tied up with famous digital artists like Sara Zucker and Refik Anadol to sell NFTs associated with their digital artwork, showcasing them in virtual galleries and real-life screens. Sotheby’s even has a gallery in the virtual world Decentraland.

Physical art. NFT helps to build trust and transparency into the traditional art market too. Considering that art has usually been a high-value space and one shrouded in mystery (there have been gruesome crimes committed for the sake of art) a reliable method of authentication and the ability to track-and-trace can solve many headaches, including counterfeiting, theft, and fraud.

“NFTs (off-chain) represent a digitised proof of ownership of an asset (or even a liability) irrespective of its nature. In the case of physical art, it effectively replaces the physical Certificate of Authenticity issued by the creators, which have always been susceptible to tampering, in the absence of an issuing authority. As an extension to the tokenisation of physical art, we also offer a tamper-evident microchip, which acts as the physical-digital link for the artwork and can be verified for authenticity using any near-field-communications (NFC) enabled mobile device. Further, the token transfer is linked to the shipment of the artwork to ensure a proper transfer of asset and acceptance before the transaction is reflected on the chain,” explains Jothi Krishnan Menon, Co-Founder & CEO, RtistiQ, an online art marketplace based in Singapore. They use NFTs in the sale of traditional physical art as well for modern digital art.

Phygital art

A use case that melds physical and digital art is where a traditional piece of artwork is digitised to extend an artist’s legacy beyond geographical boundaries. RtistiQ ventured to digitise some of Raja Ravi Varma’s privately-held paintings, which are considered national treasures and cannot be taken outside India. A gifted artist, Varma was ahead of his times. He thought that his work should reach everyone and not just the elite, and for that he set up a lithographic press in Mumbai as early as 1894! Raja Ravi Varma’s paintings of Indian gods and goddesses frequently featured on calendars, and it became a habit of the previous generation to carefully frame the pictures at the end of the year to deck up their puja rooms! Today, people across the world have a chance to own NFTs of Raja Ravi Varma’s works.

“At RtistiQ we probably started the reverse order of using NFTs for traditional mediums first, and that has started to gain acceptance as a model to meet some of the existing challenges of the industry. More recently, we have been working on different use cases extended to digital NFTs, to bring forward works of a unique nature, which may not be transactable in the physical form. In the case of the Raja Ravi Varma collection, brought out in collaboration with the Raja Ravi Varma Heritage Foundation, we tried two different models. Two of the paintings, which are privately-held and have been greatly admired, were brought out with the exclusive digital signatures of the Foundation and represented by gallery g in Bengaluru, India. Popular lithographs, recreated and embellished for enhancing the works further, were auctioned as a dual-combination of digital and physical works,” explains Menon. In March this year, tokenised versions of Raja Ravi Varma’s works were launched online by RtistiQ in collaboration with the Raja Ravi Varma Heritage Foundation and gallery g.

Recently, they have been helping Ukrainian artists who lost access to their physical paintings due to the war with Russia. They are minting digital editions using available images of the paintings, so the artists can still make a sale of their painstakingly created works. “We are working towards bringing forward more use cases as a combination of traditional and digital mediums for the art community through NFTs, where the original is difficult to experience or transact in the current form,” says Menon.

Recently, they have been helping Ukrainian artists who lost access to their physical paintings due to the war with Russia. They are minting digital editions using available images of the paintings, so the artists can still make a sale of their painstakingly created works. “We are working towards bringing forward more use cases as a combination of traditional and digital mediums for the art community through NFTs, where the original is difficult to experience or transact in the current form,” says Menon.

As artists struggle to salvage some of their works, multiple organisations, including Holy Water, Vandalz for Ukraine, Forze Ikonia, Ukraine DAO, and ArtWaRks Ukraine, are auctioning NFT collections for funding relief in the war-torn country.

Music and videos too

Art NFTs are not restricted to images but also extend to music and videos. In 2021, the background score of the film Triumph was launched as an NFT. American rapper Snoop Dogg is collaborating with Clay Nation to launch some of his unreleased music and limited-edition pitches as NFTs on the Cardano (ADA) blockchain. When you read this story, South Indian playback singer Karthik would have launched his first collection of music NFTs on India’s first fully-curated NFT marketplace, Jupiter Meta, through his special metaverse solo concert on April 14, 2022.

Twitter, Instagram, and YouTube are all planning to integrate NFT features. In a blog post about the company’s Web3 plans for 2022, YouTube mentioned introducing NFT and blockchain features to allow creators to build deeper relationships with fans and monetise their creations, while also providing fans an opportunity to own unique content. Twitter has been experimenting with hexagonal profile pictures to use NFT avatars. It will also bring in NFT authentication features along with Bitcoin and other crypto-payment systems.

Collectibles of every imaginable kind

Collectibles and memorabilia of every kind are floating around in NFT marketplaces—and pretty strange ones too. People buy NFTs of newspaper clippings, magazine covers, tweets, and memes. They buy GIFs featuring tacos, toilet paper, and cards. They buy NFT trading cards featuring key moments from the sporting world, and NFTs that represent key experiences or milestones from the lives of their favourite actors or musicians. Note that much of this, like Jack Dorsey’s first tweet or a football top shot, is already available on the Web for all to see. Why would people spend money on collecting such NFTs?

To answer this, ask yourself why people have historically collected seemingly small-value things like stamps, scale models, and sports trading cards. Well, the logic behind a collection is that its value increases when there is scarcity of the object being collected. When stamps go out of print, their value increases. Trading cards with MS Dhoni or Virat Kohli can be bought off shelves today for an insignificant price, but some years later, when cards with other faces fill the shelves, these will become scarce and valuable!

Then there is the hero worship aspect too. Fans want to own a piece of their hero’s journey—like buying the ball that went for a winning sixer, or the sneakers that an athlete wore while winning a key race. They want to collect trivia and trinkets associated with their favourite brands.

Then there is the hero worship aspect too. Fans want to own a piece of their hero’s journey—like buying the ball that went for a winning sixer, or the sneakers that an athlete wore while winning a key race. They want to collect trivia and trinkets associated with their favourite brands.

So, people buy NFT collectibles hoping that scarcity and fan-following will increase the value of these collectibles in the secondary market.

Brand marvels

Taco Bell launched a collection of taco-themed GIFs and Pizza Hut sold pixelated pizzas, while Charmin sold non-fungible toilet paper, and TIME Magazine auctioned NFTs of some of its famous covers! Adidas debuted NFTs in December 2021 and sold $23 million worth within hours. Some of their “Into the Metaverse” NFTs purchased at $765 at drop are now selling for over $2500 on OpenSea. Mahindra & Mahindra launched a collection of four NFTs featuring the all-new Thar, on Tech Mahindra’s NFT marketplace, Mahindra Gallery. The amount raised was donated to Project Nanhi Kali for the education of underprivileged girls in India. Anand Mahindra tweeted about the new experiment, “We believe it’s not just a make-believe world, it’s also a place where we can explore solutions for making the real world a better place. Only fitting that the Thar—our flagship off-roader—leads us into the uncharted landscape of NFTs.”

Brands around the world are trying to engage with their customers in the emerging digital world. Some of the brand based NFTs are assets or accessories that can be used in the virtual world, like digital sneakers or sunglasses that your avatar can wear, while others are merely collectibles that are expected to increase in value.

Sometimes, the brand based NFT comes coupled with some tangible reward—after all, the customers have shown great loyalty! For example, some of the sneaker NFTs developed by RTFKT, which Nike recently acquired, include a tradeable ticket for a physical shoe that you can collect in the future. Similarly, the winners of Mahindra’s NFTs also got a chance to experience the all-new Thar in one of Mahindra’s 4×4 off-roading tracks. Adidas’ debut NFTs offered the holder virtual wearables and the right to redeem them for physical freebies like a hoodie, a tracksuit, and a beanie! NFTs can be a great way to presell physical products in the virtual world!

Sometimes, the brand based NFT comes coupled with some tangible reward—after all, the customers have shown great loyalty! For example, some of the sneaker NFTs developed by RTFKT, which Nike recently acquired, include a tradeable ticket for a physical shoe that you can collect in the future. Similarly, the winners of Mahindra’s NFTs also got a chance to experience the all-new Thar in one of Mahindra’s 4×4 off-roading tracks. Adidas’ debut NFTs offered the holder virtual wearables and the right to redeem them for physical freebies like a hoodie, a tracksuit, and a beanie! NFTs can be a great way to presell physical products in the virtual world!

Hero worship

When Under Armour launched a series of sneaker NFTs to commemorate Stephen Curry’s NBA three-point record, it sold out in less than a minute! A single LeBron James highlight NFT sold for $200,000. Guardian Link and BeyondLife.club recently launched an exclusive collection of 250 NFTs dedicated to Indian-origin astronaut Kalpana Chawla, with never-before-seen images shared by her family. The proceeds were donated to an Indian charity for education. World over, celebrities like Snoop Dogg and Lindsay Lohan are launching unique memories and moments as securitised NFTs.

Sports collectibles

The US basketball league NBA is selling officially licensed digital collectibles under the banner NBA Top Shot. These are basically NFT trading cards embedded with notable basketball moments. After tasting success, they are now expanding into NFTs of virtual jewellery, accessories and clothing that can be used across social media.

Crictos is a series of official digital collectibles being launched by the International Cricket Council in association with FanCraze, which aims to build the ultimate cricket metaverse. Crictos gives fans a chance to own pieces of cricketing history. Different levels of Crictos are minted—ranging from common (extensively minted) to Genesis (the rarest ones). Each represents a highlight-worthy event in cricketing history. The current collections include clips from ICC World Cup 2015 and 2019. The packs are dropped on FanCraze.

“NFTs are a golden money-making opportunity for the sports industry and also a great way for sports fans to engage with their favourite teams, athletes, and historical moments. People have always loved to own sports collectibles,” says James Green, Group Investment Director at deVere, which has recently launched the dV Gems Platform to help clients identify and invest in winning NFTs.

Avatars

According to CoinMarketCap, the top seven NFT collections by market cap are avatar NFTs—headshots of cartoon characters or pixelated people. The most popular of these collections are CryptoPunks, Bored Ape Yacht Club (BAYC), and Pudgy Penguins. Quite a few studies show that avatar NFTs are overtaking metaverse game assets, fine art pieces, and sports NFTs.

Avatar NFTs can be your digital profile in the metaverse—across virtual worlds and social media platforms. Twitter, for example, lets you sport your avatar if you own one, so it becomes like a trendy and tech-savvy status symbol for many! Tonight Show host Jimmy Fallon and Grammy-winning producer Timbaland have Bored Ape NFTs as their Twitter profile pics, along with many other celebrities. Last year, Visa purchased a CryptoPunk avatar for $150,000, and Adidas purchased an Adidas-clad ape named Indigo Herz from BAYC, which is one of the key collaborators in Adidas’ NFT projects.

You can get membership to the BAYC by purchasing one of 10,000 ape profile picture NFTs, which cost at least $200,000 each. The membership gives you access to exclusive features, product drops, and events too. It allows users to mint art for the group. It gives IP control to the community, thereby having an unending source of fresh ideas. Primary and secondary resell rights ensure that the artists get paid for their efforts.

You can get membership to the BAYC by purchasing one of 10,000 ape profile picture NFTs, which cost at least $200,000 each. The membership gives you access to exclusive features, product drops, and events too. It allows users to mint art for the group. It gives IP control to the community, thereby having an unending source of fresh ideas. Primary and secondary resell rights ensure that the artists get paid for their efforts.

In-game assets

NFTs enable you to own characters or items on gaming platforms and virtual worlds. In-game assets come in many forms—ranging from creatures in Axie Infinity and trading cards in Gods Unchained to virtual real estate in Decentraland. Gaming platforms often use tokens to reward players. In the play-to-earn model followed by platforms like Axie Infinity, you earn NFT rewards within the game, which you can monetise by selling in secondary markets.

With gaming platforms growing in scale to become virtual worlds with thriving marketplaces, real-world brands are also entering the space and selling their wares. You can, for example, buy virtual sneakers from Nike or Adidas for your avatar to wear in the virtual world.

The trend is advancing towards interoperable NFTs that enable cross-platform playability. You can take your NFTs along with you to other platforms to create personalised experiences or for trading. The Enjin generic axe is one such gaming NFT that you can take along to multiple platforms!

“NFTs are a standard protocol, so they can be traded across NFT marketplaces as long as the wallet holding the tokens is compatible and on the same blockchain network. So, anyone buying an NFT from one platform can resell it on another platform by connecting their wallet and having the smart contract listed in that platform. Cross-chain compatibility (cross-chain bridge) has recently been established across a few chains for NFTs but has also been a source of vulnerabilities and hacks,” says Menon.

With the advent of currencies and assets, gaming platforms are coming under the influence of market forces much to the displeasure of traditional game developers. According to the Game Developer’s Conference 2022 Annual Report, 70% of the developers surveyed said their studios were not interested in integrating NFTs or cryptocurrencies in their games.

Nascent real-world applications

NFTs have the potential to transform several real-world processes. Experiments are underway but it will probably take time to become mainstream, because of the high costs and energy-related issues surrounding NFT usage. Nevertheless, let us take a look at some of the most promising applications:

IDs, certificates, and other documents

NFTs being immutable can result in accurate record-keeping with no risk of tampering. An NFT birth certificate can serve as a lifelong ID on the blockchain. Other medical records can be appended to the same, with complete trust and confidentiality. Some graduate schools like Emlyon in France are planning to issue NFT based diploma certificates to avoid certificate related frauds. Going forward, other important documents like passports, driving licenses, and other documents can also be encoded in the blockchain. This would help iron out kinks in several administrative processes ranging from public distribution to voting.

Real estate

In the real world, NFTs could be an efficient way to check titles and verify ownership history. Timestamped NFTs are a good way to track changes in property value. Smart contracts can be used to simplify and speed up transactions. It becomes possible to create decentralised home rental services with auto payments facilities, while taking care to protect sensitive information. In February 2022, the sale of a physical house in Tampa Bay, USA, was executed using NFTs, for a value of 210 Ether, approximately $653,000!

IP and patents

If IP is minted with a timestamped token, its current ownership and history can be easily verified and proved. Patent wars would be so easy to sort out! Sometimes, an inventor develops certain innovative IP along the way as a means to the whole. If the attempt is successful, he or she might file for a patent. If, unfortunately, the final result is not as expected, the creator can at least tokenise the successful components developed along the way and make them available to the community. These IP NFTs can also be monetised. Some researchers are considering self-publishing their work as NFTs so that their work can quickly reach the world, without the delay that is inherent in the patenting process.

Supply chain and logistics

NFTs can be used to authenticate products, verify their origin, and ensure quality. NFT based supply chain data cannot be tampered, and helps avoid counterfeiting in food, medicine, and high-value luxury products. In eco-sensitive industries, it can be used to track and trace recyclable and sustainable materials and ensure their proper recycling or reuse. Carrefour Supermarket uses NFTs to guarantee secure and unfalsifiable traceability of products. The Ownest platform also enables you to track ownership on supply chains using NFTs.

Industrial design and manufacturing

By tokenising the CAD data or files, manufacturers can ensure that their designs are not tampered or copied by contract manufacturers. File management and revisions can also be handled efficiently. Using NFTs, a manufacturer can track and trace components to ensure authenticity, and at each stage include information about the manufacturing process for the benefit of the next player in the workflow. NFT.SMARTMFG.IO from blockchain company Smart MFG Tech is a comprehensive tokenisation and marketplace solution for the creation, storage, sale, and transfer of industrial design assets as NFTs. It allows users to create and list unique NFTs, participate in auctions and commission custom-made industrial design and 3D models.

Problems aplenty

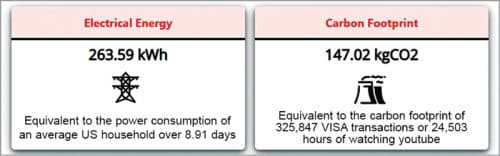

NFTs are not without their share of problems. Being a blockchain based technology, just like cryptocurrencies, it faces a lot of flak over its heavy energy usage. The proof-of-work system that keeps records secure on a blockchain is very energy-intensive. CrytoArt.wtf calculated that a simple GIF NFT can use around 200kWh for its creation, which is close to two weeks’ power consumption of an EU resident.

Some players like Sega and ArtStation dropped their NFT plans after they faced a heavy backlash from the community over energy concerns. Beeple has promised to create carbon neutral work in the future. New blockchains like Palm and Flow claim to be low-energy and carbon-neutral, and plant trees to compensate for the environmental damage, if any. Polygon claims that you can mint an NFT on its blockchain using just as much energy as it takes to send three emails. Ethereum is also rolling out Ethereum 2.0 in phases. The 2022 and 2023 upgrades will enable the platform to process thousands of transactions per second and scale globally, thereby reducing energy consumption and gas fees significantly.

Trading transactions can also be very expensive and slow because of the on-chain nature of NFTs. Experts suggest sidechains and rollups as possible solutions. Sidechains are separate blockchains that run parallel to Ethereum. A rollup takes multiple Ethereum transactions and rolls them up into a single piece of data before submitting them all to the blockchain.

Another risk is that of bit rot—the tendency of digital information to degrade or become unusable over long periods of time.

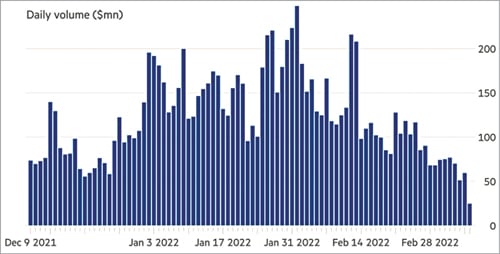

There is also the effect of frequent fluctuations inherent in the crypto-world. According to a Financial Times report, NFTs saw $41 billion in sales and huge VC investment in 2021. However, daily trading volumes in OpenSea went down by 80% in March 2022. The average selling price of NFTs and the number of accounts buying and selling NFTs also went down. This shows the fluctuating nature of this business and raises questions about its future. However, considering that the values in the crypto-world fluctuate rapidly, there is a high possibility of these figures being up when you read this article!

Despite its merits, the future of NFTs seems to be uncertain—but that is how most of today’s mainstream technologies were in their nascent stages.

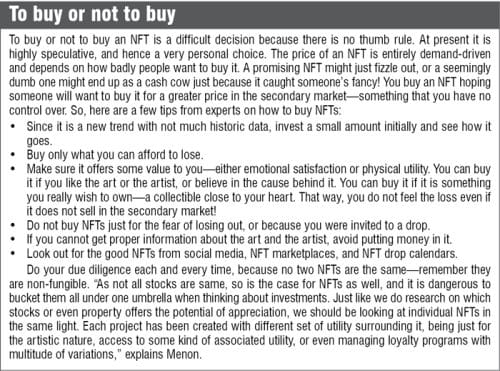

Should you invest in NFTs yet?

The blockchain and its spin-offs like cryptocurrencies and NFTs seem to be swerving from their intended path.

Ethereum co-founder Vitalik Buterin is not a big fan of NFTs as they are perceived today. Buterin, who hopes for the Ethereum to be a launchpad for all sorts of socio-political experimentation like fairer voting systems, urban planning, universal basic income, and public-works projects, is concerned about the dangers to overeager investors, the soaring transaction fees, and the shameless display of wealth that have come to dominate public perception of crypto. “The peril is you have these $3 million monkeys, and it becomes a different kind of gambling,” he says, referring to Bored Apes, when speaking to TIME magazine in March this year.

“People may have lost their mind,” says C.Z. Zhao, founder of Binance, a leading cryptocurrency exchange, who told Fortune recently, speaking of the NFT craze. He was quick to add that there is an undeniable plus, as NFTs allow artists to monetise their work globally and reach a much wider audience.

The Indian government is also discouraging crypto-investments. Amidst fear of it being banned in the country, Finance Minister Nirmala Sitharaman announced in this year’s annual Budget presentation that income from cryptocurrencies and NFT trade will henceforth be taxed at 30%. This is seen by optimistic investors as a step towards regularising crypto-investments, although the government said that it has not decided yet on the status of crypto in the country.

Surprisingly, the man who struck gold, Mike Winkelmann, also seemed worried about NFTs when speaking to Fox News Sunday last year! “I absolutely think it’s a bubble, to be quite honest. I go back to the analogy of the beginning of the internet. There was a bubble. And the bubble burst. But it didn’t wipe out the internet. And so, the technology itself is strong enough where I think it’s going to outlive that,” he remarked.

Yes, NFT as a technology is a worthy one—but better put to use to induce efficiency and transparency in existing systems. While minting and trading of NFTs can be used for meaningful engagement with fans and customers, it must not become unethical and destabilising like gambling! Over time, quick-money fads will disappear, leaving more room for beneficial applications.

Janani G. Vikram is a freelance writer based in Chennai, who loves to write on emerging technologies and Indian culture. She believes in relishing every moment of life, as happy memories are the best savings for the future