Can India turn smart cockpits into a manufacturing advantage? As automotive displays become mission-critical, a rare window opens to localise technology, skills, and policy into a global display ecosystem.

Automotive displays, once niche and premium, are now central to vehicle experience, safety, and brand differentiation, spanning instrument clusters, infotainment systems, ADAS interfaces, and heads-up displays. As Indian automotive manufacturers accelerate towards electrification, secure and connected platforms, and premium user experiences, displays are shifting from optional add-ons to essential cockpit infrastructure.

However, India’s display supply chain remains import-dependent, particularly in the automotive segment, where stringent quality, ruggedness, and integration standards apply. This presents a high-value opportunity to align three powerful forces: automotive demand, electronics manufacturing services (EMS) manufacturing depth, and the Make-in-India policy, to create a globally competitive ecosystem for automotive-grade display innovation and manufacturing.

I believe India can capitalise on this opportunity by bridging gaps in display fabrication, system integration, and skill development, while outlining a forward-looking roadmap toward self-reliance, global integration, and indigenous innovation in automotive displays.

The Evolving Role of Displays in Automotive

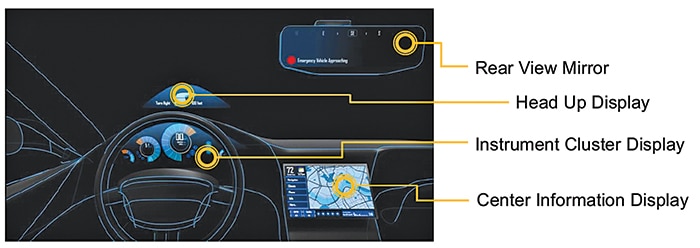

Over the past decade, automotive displays have transitioned from being functional accessories to core components of the driving experience. Today’s vehicle interiors are increasingly defined by digital interfaces; from touch-enabled infotainment systems to fully virtual instrument cluster displays, head-up displays (HUDs), rear-seat entertainment units, and ADAS visualisation panels. Future innovations are already replacing traditional side mirrors with camera-based systems and cockpit displays.

This transformation is not merely aesthetic. Displays now serve as the primary human-machine interface (HMI) between the driver, the vehicle, and the environment. They communicate critical driving information, enhance navigational clarity, deliver infotainment, and, increasingly, act as conduits for AI-based safety alerts and personalised driving experiences. The ‘smart cockpit’ has become a reality, with multi-screen dashboards, voice and gesture controls, and seamless smartphone integration redefining consumer expectations.

Globally, a rapid evolution is underway, pioneered by companies such as Tesla, BMW, Hyundai, and Mercedes-Benz, where display-rich interiors—once confined to premium models—are now cascading into mass-market vehicles. Panoramic dashboard-spanning displays, curved organic light-emitting diode (OLED) panels, and augmented-reality HUDs are setting new benchmarks for automotive user interface and user experience (UI/UX).

In India, this evolution is gaining significant traction. As the automotive market pivots toward electric and connected mobility, consumers are increasingly demanding technology-rich, safe, and personalised driving experiences, driven by digital interfaces. Even in two-wheelers, commercial fleets, and utility vehicles, ruggedised displays are being embedded for diagnostics, telematics, and navigation.

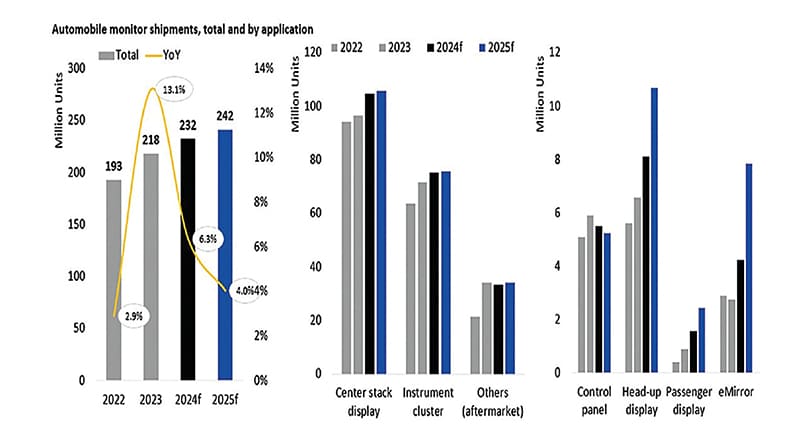

With display content per vehicle rising rapidly, and the automotive display market expected to surpass $12 billion globally by 2027, the opportunity for India is two-fold:

- To meet rising domestic demand with localised, cost-effective, automotive-grade displays

- To participate in the global supply chain as a competitive source of modules, sub-assemblies, and integrated display-HMI solutions

Yet, the path is not without its challenges. Stringent safety standards, complex integration with vehicle electronics, and durability requirements set a high bar for quality and reliability. Seizing this opportunity requires strategic alignment between industry capabilities, policy support, and focused research and development (R&D)—a theme that emerged prominently during the Society for Information Display (SID) India workshop in June.

Also read: Electrifying Shift In Automotive Display Evolution.

India’s Auto Industry: The Rise Of Displays

India has quietly emerged as the world’s third-largest automobile market, with over four million passenger vehicles sold annually and a vast two-wheeler and commercial vehicle base. Yet, until recently, the interior digital experience remained relatively underdeveloped, limited largely to basic infotainment in top-end variants.

This is now changing rapidly. As electrification, connectivity, and shared mobility reshape consumer expectations, Indian automotive original equipment manufacturers (OEMs) are responding with smart, screen-rich cockpits even in mid-segment models. Electric vehicles from Tata, Mahindra, and emerging players such as Ola Electric are integrating larger, touch-enabled displays that combine navigation, media, diagnostics, and telematics. The display is no longer a luxury; it is a functional necessity and a branding differentiator.

Moreover, the Indian buyer, digitally savvy and increasingly aspirational, is demanding global-grade cockpit experiences.

However, while demand is surging, most automotive displays continue to be imported or integrated via global Tier-1 suppliers, adding cost and limiting supply chain control. Indian EMS providers have yet to scale to automotive-grade certifications, and very few domestic firms are designing display systems from the ground up.

EMS and Display Manufacturing

India’s electronics manufacturing sector has made remarkable progress over the past decade, evolving from assembly-driven units to vertically integrated EMS providers catering to mobile phones, consumer electronics, and industrial applications. However, when it comes to automotive-grade displays, this momentum is yet to fully translate.

The opportunity is substantial. Automotive displays require not just screen panels but advanced integration capabilities, including optical bonding, ruggedised enclosures, electromagnetic interference (EMI) shielding, embedded controllers, and rigorous reliability testing. Indian EMS players such as Dixon, Syrma SGS, VVDN, and Bharat FIH have begun moving up the value chain, but certified Tier-1-level display module manufacturing remains nascent.

Most display panels—including thin-film transistor liquid crystal display (TFT LCD) and organic light-emitting diode (OLED) technologies—continue to be imported, primarily from China, Korea, and Taiwan. Key elements such as backplane technology, cover glass, bonding materials, driver integrated circuits (ICs), and touch sensor integration are not yet fully localised. The automotive sector further demands long product lifecycles, temperature resilience, vibration resistance, and compliance with safety standards such as AEC-Q100, ISO 26262, and Automotive Safety Integrity Level (ASIL) requirements, raising the bar for market entry significantly.

Yet, several green shoots are visible:

- Select EMS firms have begun investing in optical bonding lines and cleanroom facilities tailored to automotive assemblies.

- The display research ecosystem is growing through the display labs at IIT Kanpur and IIT Chennai.

- Academic interest in display physics, optics, and design is growing, catalysed by initiatives like SID India’s workshops and seminars.

- To fully seize the moment, India needs:

- Focused investments in automotive display module clusters co-located with auto hubs (like Pune, Chennai, Manesar, Sanand).

- Co-development programmes between OEMs, EMS providers, and display tech startups.

- Accelerated adoption of automotive display testing infrastructure, including vibration, thermal cycling, humidity, and optical quality benchmarks.

A unified approach that bridges EMS expertise, automotive-grade reliability, and display innovation can propel India into the global automotive display value chain, not merely as a consumer but as a creator.

Make-in-India and PLI: Enabling or Inhibiting Automotive Displays?

India’s Make-in-India campaign and production-linked incentive (PLI) schemes have undeniably accelerated the growth of electronics and component manufacturing. Mobile phone exports have surged, and semiconductor packaging is on the rise. However, in automotive displays, the policy landscape remains fragmented and underutilised.

While displays are a critical component of both automotive and consumer electronics value chains, they have not been explicitly prioritised within most existing PLI frameworks. The India Semiconductor Mission (ISM) 1.0 policy, aimed at attracting fabrication units, has seen limited traction for display fabs to date. High capital costs, long gestation periods, and global panel oversupply have made investors cautious, particularly in the absence of committed offtake from Indian automotive OEMs or a strong local Tier-1 display ecosystem.

At the same time, the recent Electronics Component Manufacturing Scheme (ECMS) policy, though helpful, continues to suffer from inverted duty structures. Automotive display modules face significantly stricter performance requirements than consumer electronics, yet current incentives are not designed to support critical elements such as optical bonding lines, automotive-grade printed circuit board (PCB) assembly, thermal and vibration testing laboratories, or rugged display controller design—all essential parts of the value chain.

There is, therefore, a growing need to design a display-focused industrial policy that recognises:

- The strategic value of cockpit digitisation in India’s mobility future

- The rising demand from domestic OEMs and Tier-1s

- The potential for mid-size EMS companies to scale up with the right policy tailwinds

- A targeted automotive display sub-mission under Make-in-India could enable:

- Local module assembly co-located with auto hubs

- Incentives for validation, reliability testing, and certification labs

- Support for startups and design-led firms working on embedded HMI and UI platforms

- Integration with ECMS, SEMICON-PLI, and R&D grant schemes to create a full-stack ecosystem

India does not lack demand or ambition; it needs convergence and clarity in policy execution. Aligning Make-in-India incentives with automotive display objectives could unlock a high-impact, globally relevant sector at the intersection of electronics, design, and mobility.

Academia and Skills: The missing link