Amid global concerns over rare-earth supply chains and copper price volatility, the UK’s AEM and Sterling Tools recently held a virtual session unveiling magnet and copper-free motors—proven in Europe and now being localised for India.

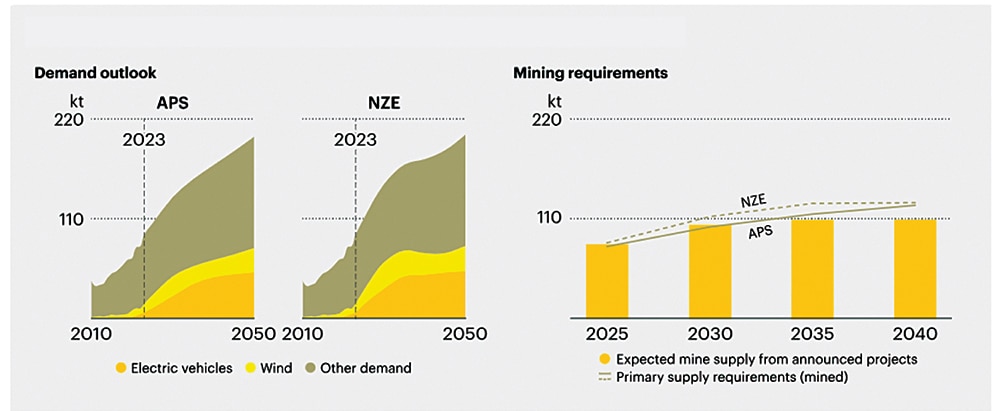

Rare-earth elements, essential for modern technologies such as electric vehicles (EVs), wind turbines, and defence systems, have been the focal point of global economic and geopolitical tensions for some time.

As of mid-2025, China accounts for approximately 60% of global rare-earth mining and over 85% of the refining capacity. It also dominates the downstream supply chain, producing more than 90% of rare-earth magnets worldwide, according to a report by Wion.

That dominance has come under renewed scrutiny. Starting in late 2023, China began tightening export controls on critical rare-earth elements like terbium and dysprosium, which are key to high-performance electric motors. By April 2024, Beijing had mandated that exporters acquire special licences, citing national security concerns and potential military applications. These restrictions followed earlier curbs on gallium and germanium, used in semiconductors and solar panels.

While China later introduced ‘green lanes’ to simplify rare-earth exports for select trading partners, such as the EU, the European Parliament responded strongly, passing a motion condemning China’s move. The non-binding but influential motion, adopted ahead of the upcoming EU-China summit, described China’s actions as coercive and unjustified. It urged the bloc to resist strategic pressure and avoid making trade concessions tied to resource access.

India, too, is feeling the pressure. Despite holding the world’s third-largest reserves of rare-earth elements (REEs), the country has historically struggled to meet production targets due to regulatory, technical, and environmental hurdles. But reportedly, that is changing. According to The Economic Times, the recently launched National Critical Mineral Mission (NCMM) aims to unlock India’s reserves through domestic exploration, public–private partnerships, and strategic alliances—particularly with resource-rich countries like Australia.

Public sector units, such as IREL, are expanding their operations, while private companies like Sona Comstar, Vedanta, and Midwest Advanced Materials are entering the magnet manufacturing and other downstream sectors. A production-linked incentive scheme worth ₹35 – ₹50 billion is also being prepared to boost local capacity.

Still, amid all this activity, a fundamental question remains: Is developing more rare-earth capacity the only option? India has been looking for alternatives for a long time.

As early as 2023, Tata Elxsi had announced an EV motor that used ferrite in place of rare-earth metals. In an interview with Electronics For You, Anush G. Nair, Senior Technology Manager at the company, detailed how the motor was designed specifically for small commercial vehicles.

“The engine has undergone testing on both a dynamo and a Tata ACE vehicle. We are currently in the conceptual testing phase. We aim to qualify it as a concept, and the design has successfully undergone various tests, all showing the motor’s performance to exceed expectations,” he said at that time.

As of mid‑2025, the ferrite-based EV motor remains in the concept/testing stage. No public announcement indicates that it has moved into mass production.

Last month, Ola Electric began exploring ferrite-based motors for its future models and has already announced the production of magnet-free motors on its official YouTube channel. According to a report by Business Standard, it plans to launch these in the third quarter of the year.

Across India, both startups and legacy players are also developing rare-earth-free motor solutions. Bengaluru’s Chara Technologies is working on synchronous reluctance motors (SynRM), while Conifer (Pune and Bay Area) and Chennai’s Viridian Ingni Propulsion are using ferrite magnets in axial-flux and hybrid designs. Ather Energy and Sona Comstar are investigating ‘light rare-earth’ materials, such as cerium and samarium, while Mahindra and Uno Minda are focusing on local magnet manufacturing.

Academic R&D is also ramping up. IIT Bhubaneswar and Numeros Motors are co-developing indigenous magnet-free topologies, VNIT has unveiled a rare-earth-free motor with up to 25% cost savings, and IIT Delhi is studying designs with minimal rare-earth input. KPIT Technologies is pushing magnet-free induction motors for heavy-duty EVs.

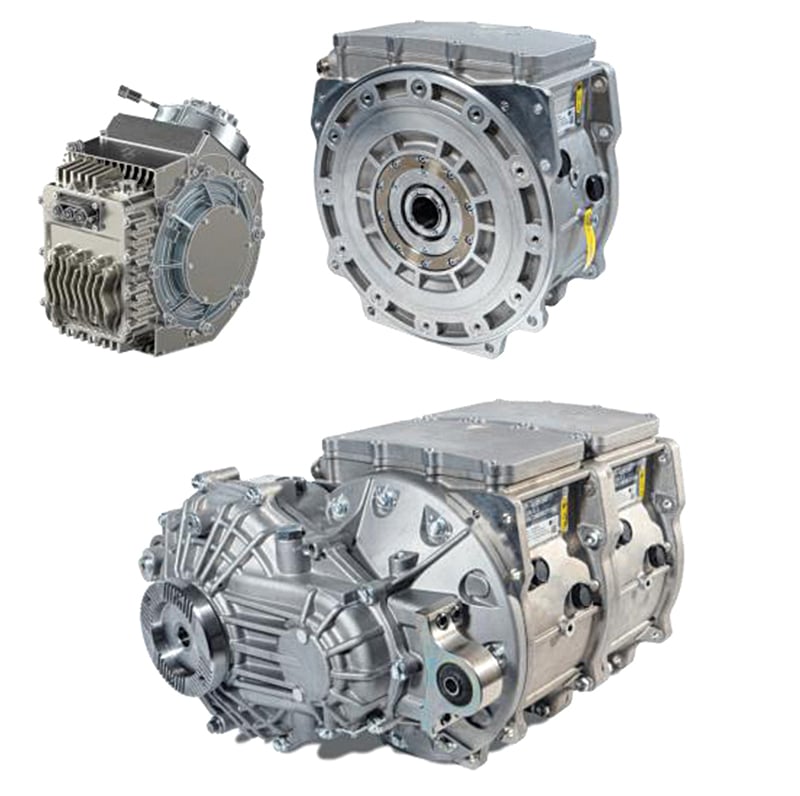

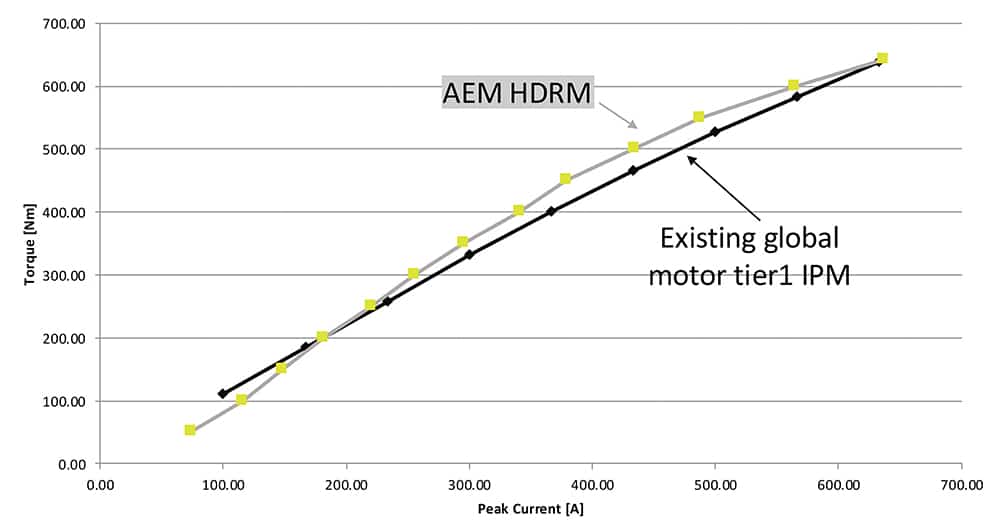

While domestic efforts to develop rare-earth-free EV motors are underway, British company Advanced Electric Machines (AEM) has taken significant strides in commercialising a new class of electric motors that eliminate both rare-earth magnets and copper windings. AEM’s high-density reluctance motor (HDRM) and super-speed reluctance drive (SSRD) offer performance comparable to traditional permanent magnet motors, while also addressing issues such as cost volatility, recyclability, and environmental impact.

Dr James Widmer, co-founder of AEM, emphasised during a recent virtual session titled ‘Rare Earth Magnet-Free Motors: Next Generation Electric Traction’ in India, that the EV industry still largely follows legacy designs from the 1990s. “We are offering something better and more sustainable,” he said. AEM’s motors are already powering commercial vehicles in Europe and have logged over 4 million kilometres. Their partnership with Sterling is now focused on localising production in India, tapping into the growing interest in magnet-free solutions.

In contrast to other Indian innovations, AEM’s approach is more radical. It eliminates both magnets and copper, replacing copper with aluminium. While TVS, Ola Electric, and Mahindra Electric are working on varying levels of localisation and rare-earth reduction, AEM’s method represents a complete technological shift rather than an incremental improvement.

James detailed the reasons driving this shift. “Rare-earths are expensive and their prices are volatile due to geopolitical tensions. With 100 million EVs projected annually by the 2040s, it is neither economically nor environmentally sustainable to depend on such materials.” Rare-earth mining often involves radioactive elements like thorium, and James warned that, if EV production scales without change, rare-earth mining could generate more low-grade nuclear waste than the nuclear power industry.

He further highlighted the challenges related to recyclability and supply chain fragility. “Recovering rare-earths and copper from end-of-life motors is extremely difficult,” he noted. In response, AEM has developed motors using recyclable materials. Their patented aluminium coil technology allows for lightweight, efficient, and scalable production. The HDRM300, initially designed for buses and trucks, delivers performance equivalent to permanent magnet motors, without using magnets or copper, resulting in a 60% weight reduction.

AEM has also miniaturised the HDRM for compact applications. “A German Tier 1 supplier commissioned us to develop a smaller version, again, rare-earth-free, half the size of the nearest competitor for the same output,” said James. The SSRD platform is currently under development for both the Indian and European passenger car markets. He emphasised that HDRM maintains high efficiency across all speeds, unlike traditional motors, and cited a customer report indicating a 12% improvement in vehicle range.

Addressing concerns around noise, James clarified that any difference is negligible. The use of aluminium in place of copper was also deliberate. Although aluminium has lower conductivity, its use significantly reduces weight and improves overall efficiency, due to AEM’s patented coil design.

Jaideep Wadhwa, Director of Sterling Tools Limited and Managing Director of Sterling GTake E-Mobility Limited, echoed James’s concerns during the same session. He questioned the viability of investing heavily in rare-earth mining in India. “China has a 45-year head start. Developing that capacity domestically would take a decade, and it is a very polluting industry,” he said, quoting a New York Times report, “2000 tonnes of waste are produced for every tonne of rare-earths mined.”

Instead, Wadhwa advocated for India to leapfrog this legacy model. “This is 30-year-old technology. If you look at what we were driving three decades ago, there is little of that you would want to drive today,” he said. He acknowledged that AEM’s motors may not be suitable for every application, but insisted they offer a robust and scalable alternative. “There are enough alternative technologies that allow us to avoid rare-earth dependence. The challenge is to develop and nurture them.”

On the broader issue of electrification, Wadhwa was unequivocal, “Yes, we must pursue it. Our crude oil import bill is $80 billion and continues to rise. We cannot make oil, but we can build electronics.” He also confirmed that one motor platform has already been localised in India with high domestic value addition. Only two components are imported, and those can be sourced from multiple global suppliers.

On the subject of production readiness, Wadhwa stated, “We’ve not built assembly lines yet because platforms vary by vehicle type. But we are close to a decision on which direction to invest.” He emphasised that the technology is both scalable and versatile.

During the Q&A session, James addressed the relatively slow adoption of magnet-free motors. “This is still new tech. We began in 2017. Earlier versions had performance compromises, but our designs do not.” Asked to compare with permanent magnet synchronous motors (PMSMs), he noted, “Half the cost of high-volume motors comes from magnets and copper. Removing those gives us a clear cost advantage.”

Another question raised was whether India’s EV industry could realistically shift to this new motor type, especially amid continued supply chain challenges related to China. Jaideep responded, “We believe this is a true drop-in replacement. We can directly replace an internal permanent magnet motor one-to-one.”

On the topic of recycling rare-earth elements, the experts were pragmatic. “Most of the recoverable rare-earths are actually from hard disk drives… So, while I am a great believer in trying to recycle and recover what we can, unfortunately, that alone is not going to solve the problem,” said James.

He noted another complication, “You certainly cannot recover all of the magnet material very easily,” particularly due to demagnetisation after prolonged use.

Concerns were also raised about Chinese dominance in the EV sector and whether this could block wider adoption of AEM’s technology. In response, James remarked, “My understanding is that none of them are making any money… So do not assume that just because they have access to rare-earths, they do not see the benefits of moving away from them.”

Regarding early adopters in India, James stated that while specifics remained confidential, he would be “very, very surprised if we do not soon see this technology out there on the streets of India.”

Wadhwa shared similar views on adoption, noting that AEM had already found success with commercial vehicle manufacturers globally, and India could follow suit. However, he admitted the timeline remains fluid. “Earlier, companies had plans to introduce these motors in 2028 or 2030… What is different now is that people are asking, ‘What can you do now?’”

The session ended on a realistic but optimistic note. “Magnet-free motors have always been on the radar, but the urgency has changed.”

Based on a white paper and webinar titled ‘Rare Earth Magnet-Free Motors: Next Generation Electric Traction,’ organised by Sterling GTake E-Mobility (SGEM) and Advanced Electric Machines (AEM) on 11 July 2025. Curated by Shubha Mitra, Assistant Editor at EFY.