Satellite communication using low Earth orbit (LEO) satellites promises to bring internet connectivity to underserved areas. However, ballpark prices make one wonder

whether the average person can afford it.

Table of Contents

Satellite communication (satcom) is not new to India. For decades, it has enabled connectivity in remote areas for defence and enterprise use—linking ATMs, bank branches, mines, aircraft, maritime operations, and military bases; aiding emergency response in rugged terrains like the Himalayas; collecting weather data from uninhabited zones; and supporting backup systems.

Now, players like Jio, Airtel, BSNL, Starlink, and Amazon aim to bring low-latency, high-speed satellite internet to individual users, especially in regions beyond the reach of terrestrial networks.

Also, check the Role of Satellites in Modern Smartphone Connectivity.

One step away from the B2C segment

As of when we write this article, Airtel (in collaboration with Eutelsat OneWeb), Jio (with SES), BSNL (with Viasat), and SpaceX’s Starlink have received two critical clearances—the Global Mobile Personal Communication by Satellite (GMPCS) license from the Department of Telecommunications (DoT) and approvals from the Indian National Space Promotion and Authorisation Centre (IN-SPACe) to operate their satellites over Indian skies, to set up their ground stations in India, and to launch commercial services.

Amazon Kuiper and Apple partner Globalstar have also applied for these and are awaiting clearance.

To receive these clearances, satcom companies must address national security concerns and agree to comply with India’s regulatory and security requirements. It requires them to set up control centres within India to ensure data localisation, service auditability, and monitoring.

This is very important because satellite communications are being used not only by the government and military of different nations but also by the mafia, drug traffickers, terrorists, and other anti-social elements for clandestine communications.

Hence, it is important to be able to track traffic, localise user data, and enforce shutdowns when necessary.

Airtel, in collaboration with OneWeb, and Jio, in partnership with SES, have also demonstrated successful proof-of-concepts in certain regions, with provisional spectrum allocation.

Meanwhile, Starlink and Amazon are planning a hybrid approach, where they will offer their services both directly and through partners. They have started inking pacts with existing satcom players, such as Hughes Communications, Nelco, and Inmarsat, to quickly enter the business-to-business (B2B) and business-to-government (B2G) markets, and with telecom majors like Airtel and Jio to tap the business-to-consumer (B2C) market.

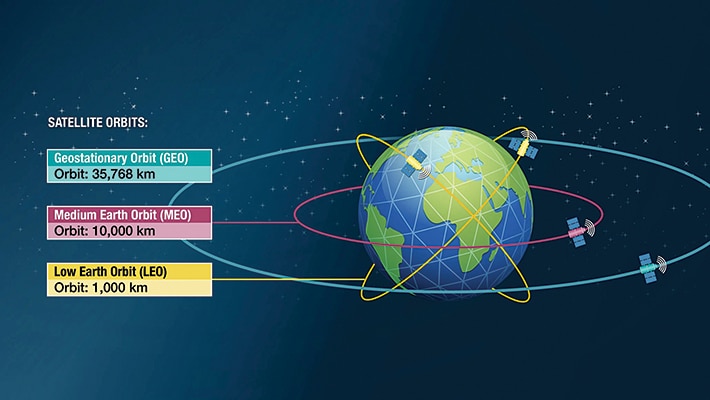

| Table 1: A comparison of low earth orbit (LEO), medium earth orbit (MEO), and geostationary earth orbit (GEO) satellites | |||

| LEO | MEO | GEO | |

| Altitude | 200-2000km | 2000-35,786km | 35,786km |

| Orbital period | 90-120 minutes | 2-24 hours | 24 hours |

| Latency (round trip) | 5-20 milliseconds (ms) | 100-180ms | 500-700+ms |

| Coverage area | Small (moves quickly) | Medium | Large (1/3rd of Earth) |

| Satellites required for global coverage | A constellation of thousands of satellites | 10 to 30 satellites | Three strategically placed satellites |

| Visibility window | 10-15 minutes | 2-8 hours | Continuous |

| Power requirements | Low | Medium | High |

| Launch cost | Low | Medium | High |

| Signal strength | Strong | Medium | Weak |

| Tracking complexity | High (fast-moving) | Medium | None (stationary) |

| Lifespan | 5-10 years | 10-15 years | 15+ years |

| Typical applications | Internet (Starlink, OneWeb), Earth observation, remote sensing, International Space Station (ISS) | Navigation (GPS, Galileo, GLONASS), communications (O3b) | TV/radio broadcasting, weather monitoring, satellite communication for static locations |

| Examples | Starlink, OneWeb, Iridium | GPS, Galileo, GLONASS | INSAT, GOES |

Note: All figures are approximate; Source: Claude Opus 4 and Gemini 2.5 Pro on Yupp.ai

The telecom industry is now eagerly waiting for the final nod—the allocation of spectrum for satellite communications. The Telecom Regulatory Authority of India (TRAI) has recommended that the DoT should allocate the spectrum administratively instead of holding an auction to speed up the launch of satellite internet services. The model would require satellite companies to pay a minimum annual charge per megahertz (MHz) and ongoing fees based on their adjusted gross revenue and number of urban subscribers (rural subscriber count is exempted as the goal is to bridge the digital divide). These rates are subject to periodic review.

While some of the key players in the telecom industry who invested heavily in 4G and 5G auctions have raised objections saying that it is unfair to exempt satellite communications from auctions, the TRAI has made it clear that satellites and mobile towers cannot be compared as satellite capacity is limited, the spectrum is shared, and the technology is less flexible. Globally, many countries allocate satellite spectrum through administrative means.

Additionally, faster satellite spectrum allocation brings the nation closer to its goal of bridging the connectivity gap in remote areas where traditional ground-based infrastructure is either not feasible or cost-effective.

As we eagerly await the arrival of satellite internet services in the Indian market, allow us to bring you up to speed on this trend.

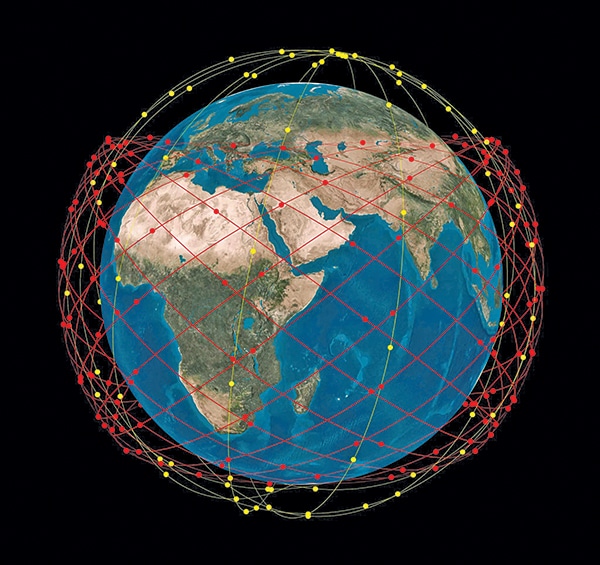

All eyes are on LEO, but GEO and MEO have not lost their charm