GST 2.0 spans electronics, EVs, drones, and renewables, offering lower costs, clearer policies, and simpler compliance. Its success depends on how rapidly

the gains flow through, aligning India’s industry with global tax frameworks.

GST, launched in 2017 to overhaul India’s indirect tax regime, remains a work in progress eight years later. Electronics and other price-sensitive sectors still feel the weight of frequent tweaks. On 3 September 2025, the GST Council cleared its most sweeping reform to date, merging rates into two slabs, 5% and 18%, while keeping 40% for demerit goods. Having seen over 500 revisions since inception, the system continues to adapt. From 22 September, the new framework is expected to ease household costs, lift sectors such as drones and EVs, and finally bring long-promised simplicity.

Electronics cheaper, sellers gear up for festive season

GST cuts have eased rates on consumer durables, with TVs, refrigerators, washing machines, air-conditioners, and dishwashers dropping from 28% to 18%, reducing prices by `1500-`2500. Retailers like Croma and Reliance Digital are rolling out discounts, exchange offers, and online deals up to 70% to spur festive demand. Other items, such as electric accumulators, ignition equipment, and select electronics, also see steep cuts, while mobiles and laptops stay at 18%. The reform relieves big-ticket appliances while keeping high-volume goods stable.

Gagan Sharma, Managing Director of XElectron, notes how GST 2.0 could reshape consumer choices: “The timing makes this move even more impactful, as the revised rates will come into effect during the festive season, when people actively purchase and gift electronics, giving a boost to the consumer electronics market.”

Drones: Lifting off with tax clarity

India’s drone sector, long hindered by fragmented taxation ranging from 5% to 28% depending on camera integration, finally has clarity. Commercial drones will now uniformly attract 5% GST, while defence drones, high-performance batteries, and critical communication systems are fully exempt.

India already has over 600 drone startups that have collectively raised more than US$500 million. With a simplified GST regime, investors and entrepreneurs now have the policy certainty needed to scale operations.

Electric vehicles: No tax hikes, more confidence

Contrary to fears, all electric vehicles (EVs)—mass-market and luxury—will continue to enjoy the 5% GST slab with no additional cess.

Vasudha Madhavan, Founder and Chief Executive Officer of Ostara Advisors, calls it significant: “By removing the tax disparity between smaller EVs and larger SUV models, the policy creates a level playing field, improves affordability, and encourages greater consumer choice. It will also accelerate growth by keeping upfront costs low and strengthening the EV component ecosystem in India.”

Meanwhile, smaller petrol and diesel cars (under 4 metres, with engines up to 1200cc petrol and 1500cc diesel) will now be taxed at 18%. Larger internal combustion engine cars and strong hybrids face a uniform 40% tax, compared with earlier effective rates of 50% and 43%.

Sanyam Gandhi, Whole-time Director at Chartered Speed, broadens the mobility perspective: “Equally important is the relief on input costs, with GST on key components such as tyres, air-conditioners, engines, and other aggregates now rationalised.”

| Key GST rate cuts for electronics |

| • Electric accumulators (excluding lithium-ion): 28%→18% • Select categories under 8525 60: 12%→5% • Electric ignition and starting equipment: 28%→18% • White goods such as TVs, refrigerators, and air-conditioners: 28%→18% Lower GST rates mean lower prices, stronger demand, and a boost for domestic electronics manufacturing. |

Renewable energy: Powered by tax breaks

Clean energy also gains under GST 2.0. Rates on renewable energy components, including solar cells, modules, wind turbines, biogas plants, and green hydrogen equipment, have been cut from 12% to 5%.

Dhruv Sharma, Chief Executive Officer of Jupiter International Limited, calls it historic: “This move not only lowers the cost of solar and clean energy solutions but also energises the entire ecosystem—manufacturers, developers, and end users alike.”

The shift is expected to reduce renewable project costs by approximately 5%, making tariffs more affordable while boosting domestic manufacturing and green investment.

Beyond tax cuts: Jobs and MSMEs

“The government’s landmark GST reform represents a crucial step in simplifying India’s indirect tax regime. By consolidating most goods and services into two slabs and retaining a 40% sin tax on harmful products, the reform is designed to boost consumer spending, stimulate corporate demand, and ease compliance for millions of small businesses,” says Sachin Alug, Chief Executive Officer of NLB Services.

Lower GST rates on automobiles, appliances, and electronics are expected to drive volumes, create multiplier effects across the manufacturing sector, and lift allied sectors such as retail, repairs, insurance, and financing.

| Transitional GST rate rules (effective September 22, 2025) |

| When supply, invoice, and payment dates fall across old (28%) and new (18%/12%→5%) rates, the time of supply rules mentioned below decide the applicable rate: • Supply+invoice+payment before 22 Sept→old rate applies • Supply before, invoice and payment after 22 Sept→new rate applies • Supply before, invoice before, payment after 22 Sept→old rate applies • Supply and invoice after 22 Sept→new rate applies (irrespective of payment date) Tip: The sequence of supply, invoice, and payment determines whether the old or new GST rate applies. |

Industry perspectives

Shashank Shekhar Gupta, a chartered accountant and lawyer, and founding partner at Marg Tax Advisors, explains that white goods, accumulators, and ignition equipment now enjoy significant cuts, potentially saving consumers up to ₹4500 on a ₹50,000 appliance.

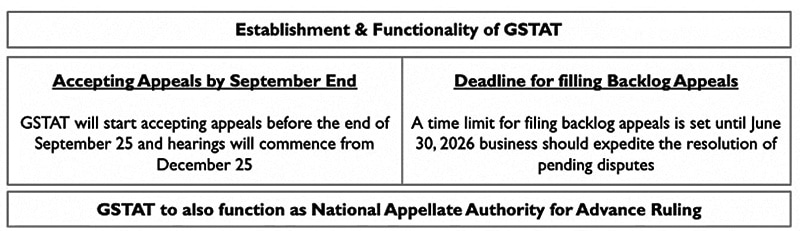

The input tax credit (ITC), once availed, remains indefeasible. Streamlined refunds will see 90% released promptly to low-risk exporters via ICEGATE (Indian Customs Electronic Gateway), while the GST Appellate Tribunal is set to launch in September 2025. Aadhaar-based checks and automatic registration aim to curb fraud, and transitional rules provide clarity for businesses.

He outlines key takeaways for the electronics industry:

- Lower consumer prices will stimulate demand and strengthen order books.

- The two-slab structure aligns India with global Value-Added Tax (VAT) models in the European Union, Gulf Cooperation Council, and Malaysia.

- Rationalised slabs encourage localisation and scaling of supply chains.

- Automated refunds will ease liquidity for products in the 5% slab.

- Faster refunds will reduce working capital pressure across the B2B chain.

- Clear HSN (harmonised system of nomenclature) codes simplify compliance.

Gautam Ray, Senior Advisor to the India Cellular and Electronics Association (ICEA), stresses that “procedural simplification is as critical as rate cuts,” pointing to time-of-supply rules and job-work ambiguities.

The industry body stated that the Central Board of Indirect Taxes and Customs (CBIC) will continue to monitor stock-keeping unit (SKU)-level prices until March 2026 to enforce anti-profiteering measures, with strong documentation required for credit notes and returns. While GST cuts are positive, dual-use products still face higher rates. Lithium-ion battery makers may claim refunds, but must pass tax savings transparently amid scrutiny and rising costs.

FAQs: Know from the experts

How will GST reforms benefit the middle class?

Electronics will see up to a 10% GST cut, making goods more affordable. Moving many items from 28% to 18% is bolder than expected and directly eases costs for consumers.

What is the monetary impact, and will the benefits be passed on?

Prices will fall substantially, leaving more disposable income. With anti-profiteering provisions phasing out, market competition will ensure the benefit reaches buyers.

What about business operations and compliance?

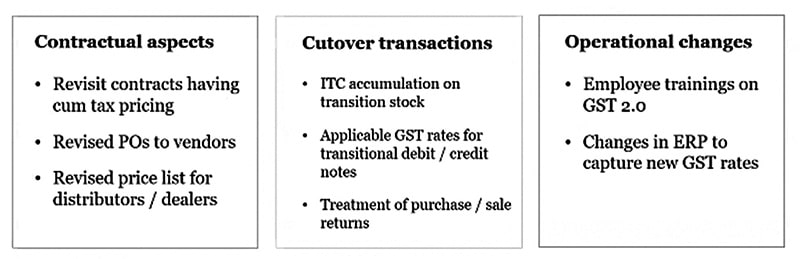

Companies are updating HSN registers and purchase records, planning refunds where inverted duty applies. A short-term dip in transactions is likely as buyers wait for lower rates, followed by a surge in demand.

What are the implications for international trade?

The two-slab structure aligns India with global VAT models. Exporters will see reduced credit accumulation, and imports will be realigned, boosting competitiveness.

Will new inverted duty structures arise?

Yes. Items moving into 5% may face accumulation of credits. However, automated refunds of up to 90% for low-risk businesses will ease liquidity pressures.

Looking ahead…

As the country heads into the festive season with what is, in theory, a fairer and simpler regime, the real test will be whether industries and retailers pass on the benefits swiftly to consumers.

Shubha Mitra is Assistant Editor at EFY, keenly interested in policies and developments shaping the electronics business.